Navigation: Deposit Reports > Deposit Reports - Numerical Order >

Availability

This report is run daily in the afterhours, if Institution Option EISU is set for your institution.

Purpose

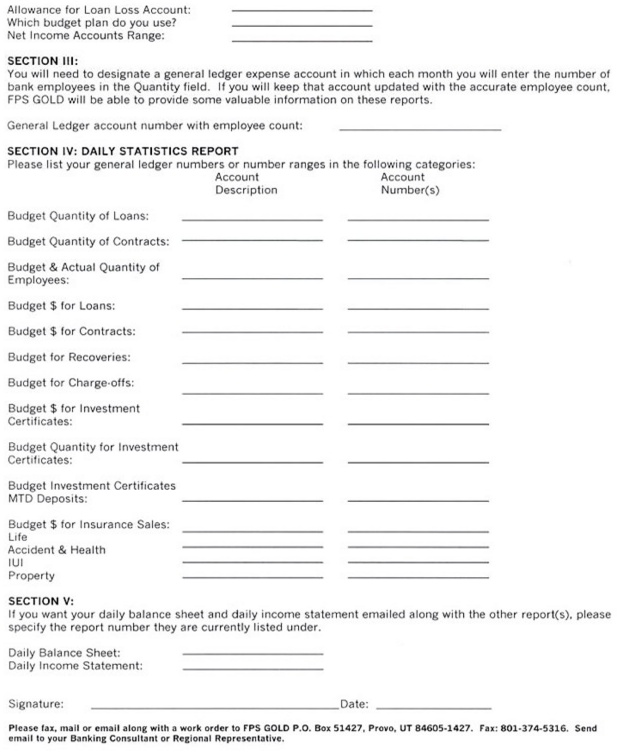

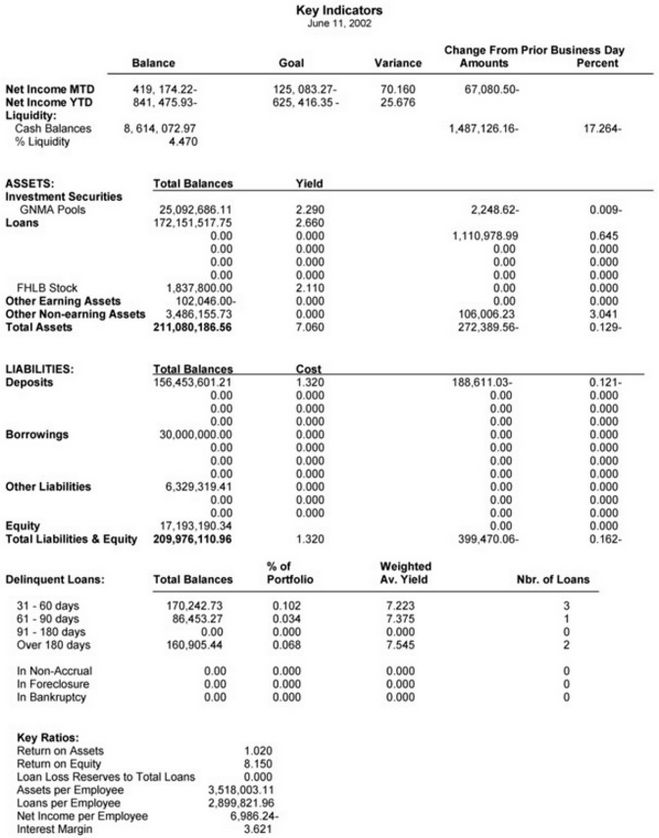

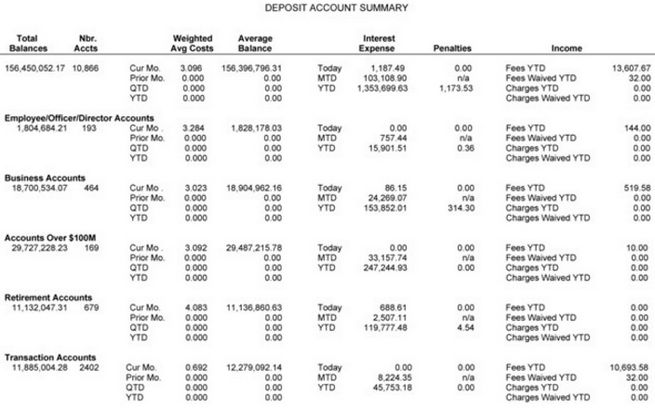

Executive Information Summary for Deposit accounts is supporting summary totals for the Executive Summary Key Indicators report, which gives you at-a-glance balance sheet, income, and key ratio information. When the report is created, it passes into a larger file that combines Deposit, Loan, and General Ledger data. During this process multiple calculations are performed. Each of these categories contains number of accounts, weighted average costs, average balances, interest expense, and penalties. This eventually creates deposit totals that are grouped by such things as employee/officer accounts and income, business accounts, retirement accounts, plus many more, then sorted by branch and product code.

The Executive Summary Key Indicators report is generated primarily for banking executives. It is e-mailed daily from GOLDPoint Systems to individuals designated by the institution. Its purpose is to provide an overview of the bank’s financial condition with embedded links to the income statement, balance sheet, and retrieval summaries of the information supporting the totals.

This report is not printable.

The General Ledger portion of the summary is created by using customized report number 8888 that is setup in group #88 and processed each night in the afterhours. Your GOLDPoint Systems Accounting Banking Consultant has to set up the report for you. The loan information is created by running the Executive Information Summary for Loans FPSRP196 each night in the afterhours.

Institution Option EISU must be set in order to use this feature.

Report Column Information

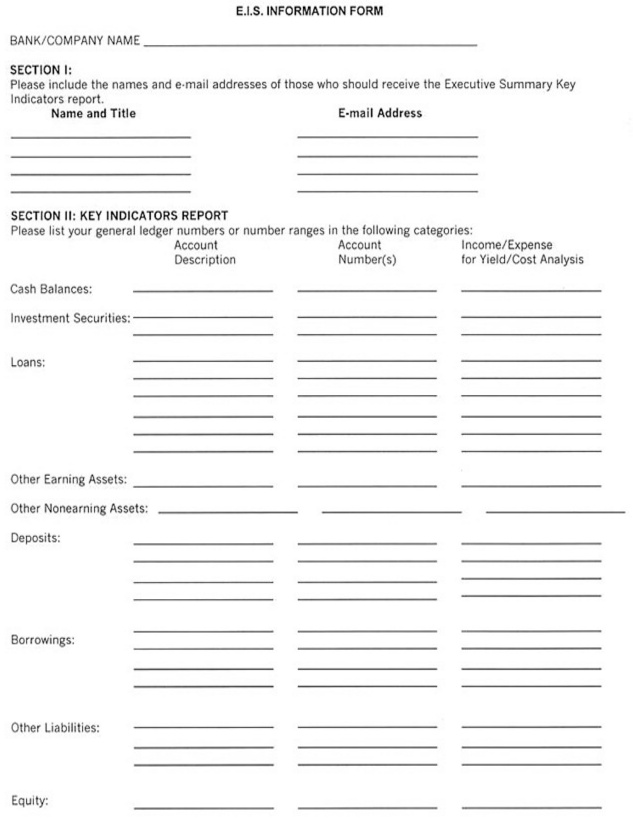

This report is created according to the information you provided on the GOLDPoint Systems E.I.S. Information form. A copy of this form can be found at the end of this chapter. The following balances and calculations are pulled from the General Ledger.

General Information

Net Income MTD Balance |

This is the month to date net income balance. |

Net Income MTD Goal |

This is the goal or budget for the month. |

Net Income MTD Variance |

This is the difference between the current balance and the goal for the month to date net income. The calculation is as follows: Balance - Goal / Balance. |

Liquidity

Change From Prior Business Day Net Income MTD Amounts |

This is the change of amounts from the prior business day for the month to date net income. The calculation is as follows: Current day - Previous day. |

Net Income YTD Balance |

This is the year to date net income balance. |

Net Income YTD Goal |

This is the year to date goal or budget. |

Net Income YTD Variance |

This is the difference between the current balance and the goal for the year to date net income. The calculation is as follows: Balance - Goal / Balance. |

Assets

Investment Securities Total Balances |

This is the total balance of all investment securities. There are two lines available to divide investment securities into specific categories. |

Investment Securities Yield |

This is the investment securities yield. There are two lines available to divide investment securities into specific categories. The calculation is as follows: Income on investment securities / Number of days in period so far x Number of days in year / Total assets. |

Change From Prior Business Day Investment Securities Amounts |

This is the change of amounts from the prior business day for the total balance of all investment securities. There are two lines available to divide investment securities into specific categories. The calculation is as follows: Current day - Previous day. |

Change From Prior Business Day Investment Securities Percent |

This is the percent change from the prior business day for the total balance of all investment securities. There are two lines available to divide investment securities into specific categories. The calculation is as follows: Current day amount - Previous day amount / Current day amount. |

Loans Total Balances |

This is the total balance of all loans. There are six lines available to divide loans into specific categories. |

Loans Yield |

This is the yield of all loans. There are six lines available to divide loans into specific categories. The calculation is as follows: Income on Loans / Number of days in period so far x Number of days in year / Total assets. |

Change From Prior Business Day Loans Amounts |

This is the change of amounts from the prior business day for the total balance of all loans. There are six lines available to divide loans into specific categories. The calculation is as follows: Current day - Previous day. |

Change From Prior Business Day Loans Percent |

This is the percent change from the prior business day for the total balance of all loans. There are six lines available to divide loans into specific categories. The calculation is as follows: Current day amount - Previous day amount / Current day amount. |

Other Earning Assets Total Balances |

This is the total balance of all other earning assets. |

Other Earning Assets Yield |

This is the yield of all other earning assets. The calculation is as follows: Income on Other Earning Assets / Number of days in period so far x Number of days in year / Total assets. |

Change From Prior Business Day Other Earning Assets Amounts |

This is the change of amounts from the prior business day for the total balance of all other earning assets. The calculation is as follows: Current day - Previous day. |

Change From Prior Business Day Other Earning Assets Percent |

This is the percent change from the prior business day for the total balance of all other earning assets. The calculation is as follows: Current day amount - Previous day amount / Current day amount. |

Other Nonearning Assets Total Balances |

This is the total balance of all other nonearning assets. |

Other Nonearning Assets Yield |

This is the yield of all other nonearning assets. The calculation is as follows: Income Other Nonearning Assets / Number of days in period so far x Number of days in year / Total assets. |

Change From Prior Business Day Other Nonearning Assets Amounts |

This is the change of amounts from the prior business day for the total balance of all other nonearning assets. The calculation is as follows: Current day - Previous day. |

Change From Prior Business Day Other Nonearning Assets Percent |

This is the percent change from the prior business day for the total of all other nonearning assets. The calculation is as follows: Current day amount - Previous day amount / Current day amount. |

Total Assets Total Balances |

This is the total balance of all assets. This balance is composed of all of the assets shown above. |

Total Assets Yield |

This is the yield of all total assets. The calculation is as follows: Income on Total Assets / Number of days in period so far x Number of days in year / Total assets. |

Change From Prior Business Day Total Assets Amounts |

This is the change of amounts from the prior business day for the total balance of all assets. The calculation is as follows: Total all assets for current day - Total all assets previous day. |

Change From Prior Business Day Total Assets Percent |

This is the percent change from the prior business day for the total balance of all assets. The calculation is as follows: Current day amount - Previous day amount / Current day amount. |

Liabilities

Deposits Total Balances |

This is the total balance of all other deposits. There are four lines available to divide deposits into specific categories. |

Deposits Cost |

This is the cost of all deposits. There are four lines available to divide deposits into specific categories. The calculation is as follows: Deposit Expense / Number of days in period so far x number of days in year / Total liabilities. |

Change From Prior Business Day Deposits Amounts |

This is the change of amounts from the prior business day for the total balance of all deposits. There are four lines available to divide deposits into specific categories. The calculation is as follows: Current day - Previous day. |

Change From Prior Business Day Deposits Percent |

This is the percent change from the prior business day for the total balance of all deposits. There are four lines available to divide deposits into specific categories. The calculation is as follows: Current day amount - Previous day amount / Current day amount. |

Borrowings Total Balances |

This is the total balance of all borrowings. There are four lines available to divide borrowings into specific categories. |

Borrowings Cost |

This is the cost of all borrowings. There are four lines available to divide borrowings into specific categories. The is calculation is as follows: Borrowings Expense / Number of days in period so far x number of days in year / Total liabilities. |

Change From Prior Business Day Borrowings Amounts |

This is the change of amounts from the prior business day for the total balance of all borrowings. There are four lines available to divide borrowings into specific categories. The calculation is as follows: Current day - Previous day. |

Change From Prior Business Day Borrowings Percent |

This is the percent change from the prior business day for the total of all borrowings. There are four lines available to divide borrowings into specific categories. The calculation is as follows: Current day amount - Previous day amount / Current day amount. |

Other Liabilities Total Balances |

This is the total balance of all other other liabilities. There are three lines available to divide other liabilities into specific categories. |

Other Liabilities Cost |

This is the cost of all other other liabilities. There are three lines available to divide other liabilities into specific categories. This is calculated as follows: Other Liabilities Expense / Number of days in period so far x number of days in year / Total liabilities. |

Change From Prior Business Day Other Liabilities Amounts |

This is the change of amounts from the prior business day for the total balance of all other liabilities. There are three lines available to divide other liabilities into specific categories. The calculation is as follows: Current day - Previous day. |

Change From Prior Business Day Other Liabilities Percent |

This is the percent change from the prior business day for the total balance of all other liabilities. There are three lines available to divide other liabilities into specific categories. The calculation is as follows: Current day amount - Previous day amount / Current day amount. |

Equity Total Balances |

This is the total equity balance. |

Change From Prior Business Day Equity Amounts |

This is the change of amounts from the prior business day for the total equity balance. The calculation is as follows: Current day - Previous day. |

Change From Prior Business Day Equity Percent |

This is the percent change from the prior business day for the total of all equity. The calculation is as follows: Current day amount - Previous day amount / Current day amount. |

Total Liabilities & Equity Total Balances |

This is the total balance of all liabilities & equity. This balance is composed of all of the liabilities & equity shown above. |

Change From Prior Business Day Total Liabilities & Equity Amounts |

This is the change of amounts from the prior business day for the total balance of all liabilities and equity. The calculation is as follows: Current day - Previous day. |

Total Liabilities & Equity Percent |

This is the percent change from the prior business day for the total liabilities and equity. The calculation is as follows: Current day amount - Previous day amount / Current day amount. |

This information is pulled from the Loan System for the current day. This section includes all loans with a general category of 0-79.

Delinquent Loans

31 - 60 days Total Balances |

This is the total balance of loans that are delinquent between 31 and 60 days. |

31 - 60 days Percent of Portfolio |

This is the percent of the loan portfolio for loans that are delinquent between 31 and 60 days. The calculation is as follows: Number of loans delinquent 31-60 days / Total number of loans. |

31 - 60 days Weighted Av. Yield |

This is the weighted average yield of loans that are delinquent between 31 and 60 days. The calculation is as follows: Balance of loans delinquent 31-60 days x weighted average yield of loans delinquent 31-60 days / Balance of loans delinquent 31-60 days. |

31 - 60 days NBR. of Loans |

This is the number of loans that are delinquent between 31 and 60 days. |

61-90 days Total Balances |

This is the total balance of loans that are delinquent between 61 and 90 days. |

61-90 days Percent of Portfolio |

This is the percent of the loan portfolio for loans that are delinquent between 61 and 90 days. The calculation is as follows: Number of loans delinquent 61-90 days / Total number of loans. |

61-90 days Weighted Av. Yield |

This is the weighted average yield of loans that are delinquent between 61 and 90 days. The calculation is as follows: Balance of loans delinquent 61-90 days x weighted average yield of loans delinquent 61-90 days / Balance of loans delinquent 61-90 days. |

61-90 days NBR. of Loans |

This is the number of loans that are delinquent between 61 and 90 days. |

91-180 days Total Balances |

This is the total balance of loans that are delinquent between 91 and 180 days. |

91-180 days Percent of Portfolio |

This is the percent of the loan portfolio for loans that are delinquent between 91 and 180 days. The calculation is as follows: Number of loans delinquent 91-180 days / Total number of loans. |

91-180 days Weighted Av. Yield |

This is the weighted average yield of loans that are delinquent between 91 and 180 days. The calculation is as follows: Balance of loans delinquent 91-180 days x weighted average yield of loans delinquent 91-180 days / Balance of loans delinquent 91-180 days. |

91-180 days NBR. of Loans |

This is the number of loans that are delinquent between 91 and 180 days. |

Over 180 days Total Balances |

This is the total balance of loans that are delinquent over 180 days. |

Over 180 days Percent of Portfolio |

This is the percent of portfolio for loans that are delinquent over 180 days. The calculation is as follows: Number of loans delinquent 180 days / Total number of loans. |

Over 180 days Weighted Av. Yield |

This is the weighted average yield of loans that are delinquent over 180 days. The calculation is as follows: Balance of loans delinquent 180 days x weighted average yield of loans delinquent 180 days / Balance of loans delinquent 180 days. |

Over 180 days NBR. of Loans |

This is the number of loans that are delinquent over 180 days. |

In Non-Accrual Total Balances |

This is the total balance of delinquent loans that are in non-accrual. Note: The non-accrual status field (LNACST) must be set. |

In Non-Accrual Percent of Portfolio |

This is the percent of the loan portfolio of loans that are in non-accrual. The calculation is as follows: Number of loans in Non-Accrual / Total number of loans. Note: The non-accrual status field (LNACST) must be set. |

In Non-Accrual Weighted Av. Yield |

This is the weighted average yield of loans that are in non-accrual. The calculation is as follows: Balance of loans in Non-Accrual x weighted average yield of loans in Non-Accrual / Balance of loans in Non-Accrual. Note: The non-accrual status field (LNACST) must be set. |

In Non-Accrual NBR. of Loans |

This is the number of delinquent loans that are in non-accrual. Note: The non-accrual status field (LNACST) must be set. |

In Foreclosure Total Balances |

This is the total balance of loans that are in foreclosure. Note: This includes loans with 1,6,7, or 9. |

In Foreclosure Percent of Portfolio |

This is the percent of the loan portfolio loans that are in foreclosure. The calculation is as follows: Number of loans in Foreclosure / Total number of loans. Note: This includes loans with 1,6,7, or 9. |

In Foreclosure Weighted Av. Yield |

This is the weighted average yield of loans that are in foreclosure. The calculation is as follows: Balance of loans in Non-Accrual x weighted average yield of loans in Foreclosure / Balance of loans in Foreclosure. Note: This includes loans with 1,6,7, or 9. |

In Foreclosure NBR. of Loans |

This is the number of loans that are in foreclosure. Note: This includes loans with 1,6,7, or 9. |

In Bankruptcy Total Balances |

This is the total balance of loans that are in bankruptcy. Note: This includes loans with hold codes 4 or 5. |

In Bankruptcy Percent of Portfolio |

This is the percent of the loan portfolio of loans that are in bankruptcy. The calculation is as follows: Number of loans in Bankruptcy / Total number of loans. Note: This includes loans with hold codes 4 or 5. |

In Bankruptcy Weighted Av. Yield |

This is the weighted average yield of loans that are in bankruptcy. The calculation is as follows: Balance of loans in Bankruptcy x weighted average yield of loans in Bankruptcy / Balance of loans in Bankruptcy. Note: This includes loans with hold codes 4 or 5. |

In Bankruptcy NBR. of Loans |

This is the number of loans that are in bankruptcy. Note: This includes loans with hold codes 4 or 5. |

Key Ratios

Return on Assets |

This is the net income divided by total assets. |

Return on Equity |

This is equity divided by total assets. |

Loan Loss Reserves to Total Loans |

This is the allowance for loan loss divided by total loans. |

Assets per Employee |

This is the total assets divided by the number of employees. |

Loans per Employee |

This is the total loans divided by the number of employees. |

Net Income per Employee |

This is the net income divided by the number of employees. |

Interest Margin |

This is the loan average yield minus the deposit average cost. |

Report Column Information

Column |

Description |

|---|---|

Total Balances |

Current Balance (DMCRBL) |

Number of accounts in category |

This is the total number of accounts in the specified category to the left of this column |

Weighted Average Cost - Current Month |

Current Balance (DMCRBL) times the Interest Rate (DMRATE) divided by Current Balance |

Weighted Average Cost - Prior Month |

Current Balance (DMCRBL) minus Month to Date Withdrawal (DMMDWD) times Current Balance |

Weighted Average Cost - QTD |

The month end average (DMMEBL) divided by number of months in the quarter |

Weighted Average Cost - YTD |

The month end average (DMMEBL) divided by number of months this year |

Average Balance - Current Month |

Current Balance (DMCRBL) for all days divided by the number of days in the month |

Average Balance - Prior Month |

This is the average balance (DMMEBL) for the previous month |

Average Balance - QTD |

This is the average balance for 3 months divided by 3 |

Average Balance - YTD |

This is the average balance for 12 months divided by 12 |

Interest Expense - Today |

All interest transactions for today (1710 tran code) |

Interest Expense - MTD |

Month to date interest (DMMDIN) |

Interest Expense - YTD |

This column displays the amount of interest paid to the account owner this year (DMIYTD) |

Penalties - Today |

All penalty transactions for today (1740 tran code) |

Penalties - MTD |

All 1740 transactions for the month |

Penalties - YTD |

Year to date penalty (DMYTDP) |

Fees - YTD |

Fees Year to Date (DMSVYD) (ECFEEY) |

Fees Waived - YTD |

This field contains the amount of service charges waived for the calendar year (ECWAVY) |

Charges - YTD |

This is the current total of all service charges for the year (DMSVYD) |

Charges Waived - YTD |

This is the current total of all the service charges waived for the year (DMSCWA) |

Employee/Officer/ Director Accounts (SMEMP or EMOFAL =Y)

Column |

Description |

|---|---|

Total Balances |

Current Balance (DMCRBL) |

Number of accounts in category |

This is the total number of accounts in the specified category to the left of this column |

Weighted Average Cost - Current Month |

Current Balance (DMCRBL) times the Interest Rate (DMRATE) divided by Current Balance |

Weighted Average Cost - Prior Month |

Current Balance (DMCRBL) minus Month to Date Withdrawal (DMMDWD) times Current Balance |

Weighted Average Cost - QTD |

The month end average (DMMEBL) divided by number of months in the quarter |

Weighted Average Cost - YTD |

The month end average (DMMEBL) divided by number of months this year |

Average Balance - Current Month |

Current Balance (DMCRBL) for all days divided by the number of days in the month |

Average Balance - Prior Month |

This is the average balance (DMMEBL) for the previous month |

Average Balance - QTD |

This is the average balance for 3 months divided by 3 |

Average Balance - YTD |

This is the average balance for 12 months divided by 12 |

Interest Expense - Today |

All interest transactions for today (1710 tran code) |

Interest Expense - MTD |

Month to date interest (DMMDIN) |

Interest Expense - YTD |

This column displays the amount of interest paid to the account owner this year (DMIYTD) |

Penalties - Today |

All penalty transactions for today (1740 tran code) |

Penalties - MTD |

All 1740 transactions for the month |

Penalties - YTD |

Year to date penalty (DMYTDP) |

Fees - YTD |

Fees Year to Date (DMSVYD) (ECFEEY) |

Fees Waived - YTD |

This field contains the amount of service charges waived for the calendar year (ECWAVY) |

Charges - YTD |

This is the current total of all service charges for the year (DMSVYD) |

Charges Waived - YTD |

This is the current total of all the service charges waived for the year (DMSCWA) |

Business Accounts (DMPERS = N)

Column |

Description |

|---|---|

Total Balances |

Current Balance (DMCRBL) |

Number of accounts in category |

This is the total number of accounts in the specified category to the left of this column |

Weighted Average Cost - Current Month |

Current Balance (DMCRBL) times the Interest Rate (DMRATE) divided by Current Balance |

Weighted Average Cost - Prior Month |

Current Balance (DMCRBL) minus Month to Date Withdrawal (DMMDWD) times Current Balance |

Weighted Average Cost - QTD |

The month end average (DMMEBL) divided by number of months in the quarter |

Weighted Average Cost - YTD |

The month end average (DMMEBL) divided by number of months this year |

Average Balance - Current Month |

Current Balance (DMCRBL) for all days divided by the number of days in the month |

Average Balance - Prior Month |

This is the average balance (DMMEBL) for the previous month |

Average Balance - QTD |

This is the average balance for 3 months divided by 3 |

Average Balance - YTD |

This is the average balance for 12 months divided by 12 |

Interest Expense - Today |

All interest transactions for today (1710 tran code) |

Interest Expense - MTD |

Month to date interest (DMMDIN) |

Interest Expense - YTD |

This column displays the amount of interest paid to the account owner this year (DMIYTD) |

Penalties - Today |

All penalty transactions for today (1740 tran code) |

Penalties - MTD |

All 1740 transactions for the month |

Penalties - YTD |

Year to date penalty (DMYTDP) |

Fees - YTD |

Fees Year to Date (DMSVYD) (ECFEEY) |

Fees Waived - YTD |

This field contains the amount of service charges waived for the calendar year (ECWAVY) |

Charges - YTD |

This is the current total of all service charges for the year (DMSVYD) |

Charges Waived - YTD |

This is the current total of all the service charges waived for the year (DMSCWA) |

Accounts Over 100M (DMCRBL > 100,000.00)

Column |

Description |

|---|---|

Total Balances |

Current Balance (DMCRBL) |

Number of accounts in category |

This is the total number of accounts in the specified category to the left of this column |

Weighted Average Cost - Current Month |

Current Balance (DMCRBL) times the Interest Rate (DMRATE) divided by Current Balance |

Weighted Average Cost - Prior Month |

Current Balance (DMCRBL) minus Month to Date Withdrawal (DMMDWD) times Current Balance |

Weighted Average Cost - QTD |

The month end average (DMMEBL) divided by number of months in the quarter |

Weighted Average Cost - YTD |

The month end average (DMMEBL) divided by number of months this year |

Average Balance - Current Month |

Current Balance (DMCRBL) for all days divided by the number of days in the month |

Average Balance - Prior Month |

This is the average balance (DMMEBL) for the previous month |

Average Balance - QTD |

This is the average balance for 3 months divided by 3 |

Average Balance - YTD |

This is the average balance for 12 months divided by 12 |

Interest Expense - Today |

All interest transactions for today (1710 tran code) |

Interest Expense - MTD |

Month to date interest (DMMDIN) |

Interest Expense - YTD |

This column displays the amount of interest paid to the account owner this year (DMIYTD) |

Penalties - Today |

All penalty transactions for today (1740 tran code) |

Penalties - MTD |

All 1740 transactions for the month |

Penalties - YTD |

Year to date penalty (DMYTDP) |

Fees - YTD |

Fees Year to Date (DMSVYD) (ECFEEY) |

Fees Waived - YTD |

This field contains the amount of service charges waived for the calendar year (ECWAVY) |

Charges - YTD |

This is the current total of all service charges for the year (DMSVYD) |

Charges Waived - YTD |

This is the current total of all the service charges waived for the year (DMSCWA) |

Retirement Accounts (DMDFRT = Y)

Column |

Description |

|---|---|

Total Balances |

Current Balance (DMCRBL) |

Number of accounts in category |

This is the total number of accounts in the specified category to the left of this column |

Weighted Average Cost - Current Month |

Current Balance (DMCRBL) times the Interest Rate (DMRATE) divided by Current Balance |

Weighted Average Cost - Prior Month |

Current Balance (DMCRBL) minus Month to Date Withdrawal (DMMDWD) times Current Balance |

Weighted Average Cost - QTD |

The month end average (DMMEBL) divided by number of months in the quarter |

Weighted Average Cost - YTD |

The month end average (DMMEBL) divided by number of months this year |

Average Balance - Current Month |

Current Balance (DMCRBL) for all days divided by the number of days in the month |

Average Balance - Prior Month |

This is the average balance (DMMEBL) for the previous month |

Average Balance - QTD |

This is the average balance for 3 months divided by 3 |

Average Balance - YTD |

This is the average balance for 12 months divided by 12 |

Interest Expense - Today |

All interest transactions for today (1710 tran code) |

Interest Expense - MTD |

Month to date interest (DMMDIN) |

Interest Expense - YTD |

This column displays the amount of interest paid to the account owner this year (DMIYTD) |

Penalties - Today |

All penalty transactions for today (1740 tran code) |

Penalties - MTD |

All 1740 transactions for the month |

Penalties - YTD |

Year to date penalty (DMYTDP) |

Fees - YTD |

Fees Year to Date (DMSVYD) (ECFEEY) |

Fees Waived - YTD |

This field contains the amount of service charges waived for the calendar year (ECWAVY) |

Charges - YTD |

This is the current total of all service charges for the year (DMSVYD) |

Charges Waived - YTD |

This is the current total of all the service charges waived for the year (DMSCWA) |

Transaction Accounts (DMGENL = 8, 7, 10, 9, 1)

Column |

Description |

|---|---|

Total Balances |

Current Balance (DMCRBL) |

Number of accounts in category |

This is the total number of accounts in the specified category to the left of this column |

Weighted Average Cost - Current Month |

Current Balance (DMCRBL) times the Interest Rate (DMRATE) divided by Current Balance |

Weighted Average Cost - Prior Month |

Current Balance (DMCRBL) minus Month to Date Withdrawal (DMMDWD) times Current Balance |

Weighted Average Cost - QTD |

The month end average (DMMEBL) divided by number of months in the quarter |

Weighted Average Cost - YTD |

The month end average (DMMEBL) divided by number of months this year |

Average Balance - Current Month |

Current Balance (DMCRBL) for all days divided by the number of days in the month |

Average Balance - Prior Month |

This is the average balance (DMMEBL) for the previous month |

Average Balance - QTD |

This is the average balance for 3 months divided by 3 |

Average Balance - YTD |

This is the average balance for 12 months divided by 12 |

Interest Expense - Today |

All interest transactions for today (1710 tran code) |

Interest Expense - MTD |

Month to date interest (DMMDIN) |

Interest Expense - YTD |

This column displays the amount of interest paid to the account owner this year (DMIYTD) |

Penalties - Today |

All penalty transactions for today (1740 tran code) |

Penalties - MTD |

All 1740 transactions for the month |

Penalties - YTD |

Year to date penalty (DMYTDP) |

Fees - YTD |

Fees Year to Date (DMSVYD) (ECFEEY) |

Fees Waived - YTD |

This field contains the amount of service charges waived for the calendar year (ECWAVY) |

Charges - YTD |

This is the current total of all service charges for the year (DMSVYD) |

Charges Waived - YTD |

This is the current total of all the service charges waived for the year (DMSCWA) |

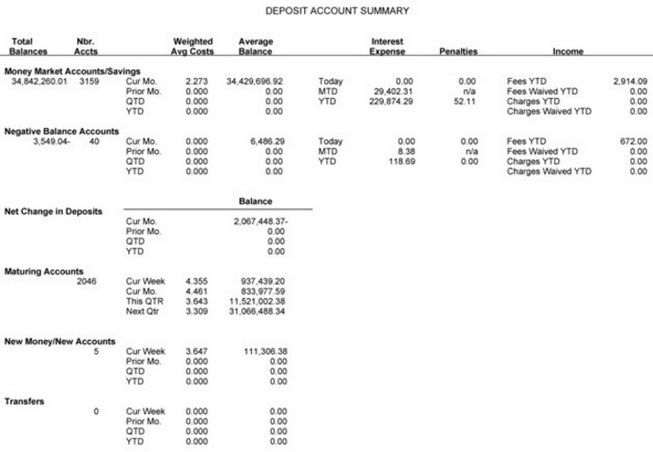

Money Market Accounts/Savings (DMGENL = 6, 5)

Column |

Description |

|---|---|

Total Balances |

Current Balance (DMCRBL) |

Number of accounts in category |

This is the total number of accounts in the specified category to the left of this column |

Weighted Average Cost - Current Month |

Current Balance (DMCRBL) times the Interest Rate (DMRATE) divided by Current Balance |

Weighted Average Cost - Prior Month |

Current Balance (DMCRBL) minus Month to Date Withdrawal (DMMDWD) times Current Balance |

Weighted Average Cost - QTD |

The month end average (DMMEBL) divided by number of months in the quarter |

Weighted Average Cost - YTD |

The month end average (DMMEBL) divided by number of months this year |

Average Balance - Current Month |

Current Balance (DMCRBL) for all days divided by the number of days in the month |

Average Balance - Prior Month |

This is the average balance (DMMEBL) for the previous month |

Average Balance - QTD |

This is the average balance for 3 months divided by 3 |

Average Balance - YTD |

This is the average balance for 12 months divided by 12 |

Interest Expense - Today |

All interest transactions for today (1710 tran code) |

Interest Expense - MTD |

Month to date interest (DMMDIN) |

Interest Expense - YTD |

This column displays the amount of interest paid to the account owner this year (DMIYTD) |

Penalties - Today |

All penalty transactions for today (1740 tran code) |

Penalties - MTD |

All 1740 transactions for the month |

Penalties - YTD |

Year to date penalty (DMYTDP) |

Fees - YTD |

Fees Year to Date (DMSVYD) (ECFEEY) |

Fees Waived - YTD |

This field contains the amount of service charges waived for the calendar year (ECWAVY) |

Charges - YTD |

This is the current total of all service charges for the year (DMSVYD) |

Charges Waived - YTD |

This is the current total of all the service charges waived for the year (DMSCWA) |

Negative Balance Accounts (DMCRBL < 0)

Column |

Description |

|---|---|

Total Balances |

Current Balance (DMCRBL) |

Number of accounts in category |

This is the total number of accounts in the specified category to the left of this column |

Weighted Average Cost - Current Month |

Current Balance (DMCRBL) times the Interest Rate (DMRATE) divided by Current Balance |

Weighted Average Cost - Prior Month |

Current Balance (DMCRBL) minus Month to Date Withdrawal (DMMDWD) times Current Balance |

Weighted Average Cost - QTD |

The month end average (DMMEBL) divided by number of months in the quarter |

Weighted Average Cost - YTD |

The month end average (DMMEBL) divided by number of months this year |

Average Balance - Current Month |

Current Balance (DMCRBL) for all days divided by the number of days in the month |

Average Balance - Prior Month |

This is the average balance (DMMEBL) for the previous month |

Average Balance - QTD |

This is the average balance for 3 months divided by 3 |

Average Balance - YTD |

This is the average balance for 12 months divided by 12 |

Interest Expense - Today |

All interest transactions for today (1710 tran code) |

Interest Expense - MTD |

Month to date interest (DMMDIN) |

Interest Expense - YTD |

This column displays the amount of interest paid to the account owner this year (DMIYTD) |

Penalties - Today |

All penalty transactions for today (1740 tran code) |

Penalties - MTD |

All 1740 transactions for the month |

Penalties - YTD |

Year to date penalty (DMYTDP) |

Fees - YTD |

Fees Year to Date (DMSVYD) (ECFEEY) |

Fees Waived - YTD |

This field contains the amount of service charges waived for the calendar year (ECWAVY) |

Charges - YTD |

This is the current total of all service charges for the year (DMSVYD) |

Charges Waived - YTD |

This is the current total of all the service charges waived for the year (DMSCWA) |

Net Change in Deposits

Column |

Description |

|---|---|

Current Month |

This is the month to date withdrawals (DMMDWD) minus month to date deposits (DMMDDP) |

Prior Month |

This is the difference between last month’s deposits and withdrawals |

Quarter to Date |

This is the difference between last quarter’s deposits and withdrawals |

Year to Date |

This is the difference between last year’s deposits and withdrawals |

Maturing Accounts

Column |

Description |

|---|---|

Total Balances |

Current Balance (DMCRBL) |

Number of accounts in category |

This is the total number of accounts in the specified category to the left of this column |

Balance - Current Week |

Current Balance (DMCRBL) if Maturity Date equals today + 7 days |

Balance - Current Month |

Current Balance (DMCRBL) if Maturity Date equals this month |

Balance - This Quarter |

Current Balance (DMCRBL) if Maturity Date equals this quarter |

Balance - Next Quarter |

Current Balance (DMCRBL) if Maturity Date equals next quarter |

New Money/New Accounts

Column |

Description |

|---|---|

Total Balances |

Current Balance (DMCRBL) |

Number of accounts in category |

This is the total number of accounts in the specified category to the left of this column |

Balance - Current Month |

Current Balance (DMCRBL) if date opened equals this month |

Balance - Prior Month |

Current Balance (DMCRBL) if date opened equals the prior month |

Balance - QTD |

Current Balance (DMCRBL) if date opened is in the current quarter |

Balance - YTD |

Current Balance (DMCRBL) if date opened is in the current year |

Transfers

Column |

Description |

|---|---|

Total Balances |

Current Balance (DMCRBL) |

Number of accounts in category |

This is the total number of accounts in the specified category to the left of this column |

Balance - Current Month |

Current Balance (DMCRBL) if date opened equals this month |

Balance - Prior Month |

Current Balance (DMCRBL) if date opened equals the prior month |

Balance - QTD |

Current Balance (DMCRBL) if date opened is in the current quarter |

Balance - YTD |

Current Balance (DMCRBL) if date opened is in the current year |