Navigation: Deposit Reports > Deposit Reports - Numerical Order >

Availability

This report must be processed daily. It provides detail of proof batches.

Purpose

The Proof Items for Posting Report groups all items in a transaction together and shows whether or not the transaction was in balance when it was transmitted to GOLDPoint Systems. This report is mainly a research tool used to trace transactions back to the individual paper items in a proof batch. Each transaction must be sent to GOLDPoint Systems in a specific order; first credits followed by debits. When the system finds the next credit, it assumes it is looking at the next transaction. Uncollected funds holds are placed based on a field attached to each check. The valid entries for the field are 0 - no hold, 1 - local hold, and 2 - non-local hold. The hold is placed on the first credit item’s account number. Any subsequent account credits will be ignored for uncollected funds.

1.Proof items for posting. This sort lists all parts of transactions in the order they are sent in the file.

2.Account number order. This sort lists General Ledger tickets, cash tickets, not-on-us checks, then account debit or credit tickets.

3.Amount order. This sort lists all transactions by amount starting with .01. General Ledger, cash tickets, loan coupons, deposit slips, etc. are all intermingled by dollar amount.

|

GOLDPoint Systems Only: The sorting and subtotal fields that may be used for this report are as follows:

80 Account number 81 Amount

The critical from field must be set to “1” to “4,” even when using sorting fields 80 and 81. These two sorts aid in research by sorting the proof items by the account number or by the transaction amount.

One miscellaneous option is used on this report. It is the left-most position of the 16th option. It is used to suppress the balancing of individual transactions. This option should always be set to “Y” when using either of the two sort fields mentioned above. This option should be off when not using a sort field. |

|---|

Deposit Transactions in Proof Batches

Deposit transactions sent in proof batches do not post in the order they are sent. They are sorted by account number and then processed with other system and batch transactions. Proof transactions can be sent through with specific proof transaction codes that are designated as force posts. Check cashing and miscellaneous debit transactions are processed before other transactions. Transactions are sorted by a system-defined priority number within the transaction origination code (TORC). This list does not represent everything that is prioritized, but it does list all the monetary transactions applicable to this report.

Transaction |

TORC |

Priority |

Description |

1120 |

Proof 307 |

10 |

Account openings and deposits |

1710 |

307 |

12 |

Interest postings |

1780 |

307 |

14 |

Misc. credits |

1220 |

307 |

16 |

Retirement contributions |

1760 |

307 |

18 |

Prepaid retirement fees |

1810 |

307 |

20 |

General Ledger credits |

1540 |

307 |

22 |

Cash-out tickets |

1200 |

307 |

24 |

Retirement account openings |

1750 |

307 |

25 |

Misc. debits (force pay) |

1400 |

307 |

26 |

Cashed checks (force pay) |

1130 |

307 |

27 |

Withdrawals |

1230 |

307 |

28 |

Retirement distributions |

1700 |

307 |

Interest withholdings |

|

1730 |

307 |

Interest withdrawals |

|

1740 |

307 |

Interest penalties |

|

1190 |

307 |

29 |

Account closings |

1290 |

307 |

Retirement account closings |

|

1550 |

307 |

Cash-in tickets |

|

1810 |

ACH 305 |

30 |

General Ledger credits |

1120 |

ATM 301 |

40 |

Deposit transactions |

1120 |

POS 302 |

45 |

Deposit transactions |

1120 |

316 |

Deposit transactions |

|

1120 |

366 |

Deposit transactions |

|

1950 |

ACH 305 |

48 |

Pre-notifications |

1120 |

378 |

50 |

Master Card MAPP advances |

1120 |

376 |

eACH batch offsets |

|

1220 |

305 |

Retirement deposit transactions |

|

1220 |

380 |

Fiserv EFT retirement deposit transactions |

|

1120 |

309 |

Check order credits (up-charges) |

|

1120 |

ATM 314 |

Batch deposit internal transactions |

|

1120 |

CDT 325 |

Auto-deposit internal transfers |

|

1220 |

325 |

Retirement auto deposit transfers |

|

1120 |

340 |

Auto deposit external transfers |

|

1220 |

340 |

Retirement auto deposit external transfers |

|

1120/1220 |

P/R 350 |

GOLDPoint Systems payroll deposits |

|

1120 |

LNS 351 |

Deposit custodial P/I credits |

|

1120 |

352 |

Deposit custodial S/U credits |

|

1120 |

353 |

Deposit custodial T/I credits |

|

1400 |

CDT 377 |

OTC hold for check drafts Bill Payer |

|

1130 |

ATM 301 |

100 |

Withdrawal transactions |

1130 |

314 |

Withdrawal transactions |

|

1130 |

POS 302 |

102 |

Withdrawal transactions |

1130 |

316 |

Withdrawal transactions |

|

1130 |

366 |

Withdrawal transactions |

|

1800 |

ACH 305 |

128 |

General Ledger debits |

1130 |

LNS 321 |

148 |

Automatic withdrawal transactions for loan payments |

1130 |

381 |

Automatic withdrawal transactions for loan payments |

|

1130 |

ACH 309 |

149 |

Check charges transactions |

1130 |

305 |

150 |

Withdrawal transactions |

1130 |

376 |

eACH offsets |

|

1130 |

378 |

MasterCard MAPP debits |

|

1230 |

305 |

Retirement withdrawal transactions |

|

1230 |

380 |

Fiserv retirement withdrawal transactions |

|

1130 |

CDT 326 |

Automatic internal withdrawal transactions |

|

1130 |

341 |

Automatic external withdrawal transactions |

|

1130 |

327 |

Bill payment by check transactions |

|

1130 |

342 |

Bill payment internal transactions |

|

1130 |

343 |

Bill payment external transactions |

|

1130 |

365 |

Bill payment to MasterCard transactions |

|

1230 |

328 |

Retirement distribution by check transactions |

|

1230 |

344 |

Internal retirement distribution transactions |

|

1230 |

345 |

External retirement distribution transactions |

|

1130 |

LNS 352 |

Custodial P/I transactions |

|

1130 |

353 |

Custodial S/U transactions |

|

1130 |

354 |

Custodial T/I transactions |

|

1130 |

INCL 306 |

160 |

Inclearing check withdrawal transactions |

1790 |

BOX 375 |

199 |

Charge safe deposit box fees |

1750 |

SER 303 |

200 |

Process service charges |

1780 |

303 |

Process service charge credits |

|

1750 |

339 |

Process retirement service charges |

Loan Transactions in Proof Batches

Loan transactions sent in proof batches do not post in the order they are sent. They are sorted by account number and then processed with other system and batch transactions. Loan transactions are sorted by a system-defined priority number, not by the proof code. The list below generally represents monetary transactions applicable to this report, but may be different depending on which program is running.

Transaction |

Priority |

Description |

|---|---|---|

680 |

5 |

New loan |

520 |

10 |

Assess finance charges |

600 |

15 |

Loan payment |

601 |

15 |

Loan payment from partial |

520 |

16 |

Assess finance charge after payment |

510 |

20 |

First 510 credit field |

510 |

20 |

Field credit to interest |

518 |

23 |

First 518 credit field correction |

510 |

25 |

Field credit to LIP balance |

510 |

30 |

Field credit to LIP customer balance |

510 |

35 |

Field credit to reserve 1 |

510 |

40 |

Field credit to reserve 2 |

510 |

45 |

Field credit to deferred interest |

510 |

50 |

Field credit to partial payments |

510 |

55 |

Field credit to deferred fees |

510 |

60 |

Field credit to LIP interest |

510 |

65 |

Field credit to subsidy balance |

510 |

70 |

Field credit to miscellaneous funds |

500 |

80 |

First 500 debit field |

500 |

80 |

Field debit to interest |

508 |

83 |

First 508 debit correction field |

500 |

85 |

Field debit to LIP balance |

500 |

90 |

Field debit to LIP customer balance |

500 |

95 |

Field debit to reserve 1 |

500 |

100 |

Field debit to reserve 2 |

500 |

105 |

Field debit to deferred interest |

500 |

110 |

Field debit to partial payment |

500 |

115 |

Field debit to deferred fees |

500 |

120 |

Field debit to LIP interest |

500 |

125 |

Field debit to subsidy balance |

500 |

130 |

Field debit to miscellaneous funds |

430 |

140 |

LIP disbursement |

550 |

145 |

Pay late charges |

610 |

150 |

Pay interest on reserve 1 |

620 |

155 |

Pay interest on reserve 2 |

630 |

160 |

Pay interest on subsidy balance |

440 |

165 |

Reserve 1 disbursement |

640 |

170 |

Reserve 2 disbursement |

510 |

172 |

Field credit to principal balance |

650 |

175 |

Prepaid interest |

658 |

178 |

Prepaid interest—correction |

590 |

180 |

Charge interest |

598 |

183 |

Charge interest—correction |

540 |

185 |

Rule of 78s rebate |

530 |

190 |

Accrue interest to today |

80 |

195 |

Amortize deferred premiums |

450 |

195 |

Amortize deferred fees |

451 |

195 |

Amortize fees |

460 |

195 |

Amortize commission |

760 |

195 |

Amortize commission cost |

350 |

195 |

Amortize dealer interest |

70 |

200 |

Amortize deferred discount |

420 |

200 |

Amortize deferred costs |

490 |

200 |

Rebate commission |

531 |

191 |

Amortize payment method 3 G/L interest |

532 |

200 |

Amortize insurance finance charge |

790 |

200 |

Rebate commission cost |

570 |

205 |

Waive late charges |

560 |

210 |

Assess late charges |

660 |

210 |

Assess miscellaneous fee |

580 |

220 |

Loan payoff transaction |

830 |

221 |

Loan payoff transaction |

500 |

232 |

Field debit to principal balance |

535 |

235 |

Capitalize interest |

590 |

252 |

Post LIP interest |

840 |

255 |

Amortize deferred mortgage rights |

Report Column Information

See FPSDR025 Example for an example of this report.

Column |

Description |

|---|---|

Seqnce Number |

The sequence number is a number assigned by the system to each item in a proof batch. It represents the actual order in which the items were received by GOLDPoint Systems. |

Proof Code |

The proof code is a two-digit transaction code encoded on the MICR line of an individual item. There is a table in the Totals Provided section below that translates this proof code into the GOLDPoint Systems four-digit transaction code. |

Tran Code |

The tran code is the four-digit GOLDPoint Systems transaction code. It is derived from the proof code on the individual item. |

Tr Md |

This is the transaction modifier associated with the transaction code. The transaction modifier can be sent as an extension of the transaction code, a retirement modifier, a descriptor code on miscellaneous debits and credits, or a loan field amount number (e.g., 47 = principal, 62 = reserve). |

Transaction Description |

This is the description of the transaction. |

Account Number |

This is the account number associated with the transaction. It may be in the customer account format or a General Ledger account format, depending on which type of account the transaction is for. Some items, such as a check not on us, will not have anything in the Account Number field. |

Transaction Amount |

This is the amount of the item, which may be the amount posted to an account or a portion of the transaction. |

Uncl Fnds |

This is the uncollected funds indicator. The possible values here are blank for no uncollected funds, LOCL for a local hold, and NLCL for a non-local hold. The time periods for the local and non-local holds are determined by individual institution options (UDHD). The holds are passed as float numbers in the proof transmission and are assigned to the first deposit account credit item in the transaction. |

Transaction Information |

This column contains information about the transaction. For example, if an invalid proof code came on this item, a message would print showing that the program was unable to resolve this item. If the item were a check clearing on a customer account, a message would print showing the customer check number. |

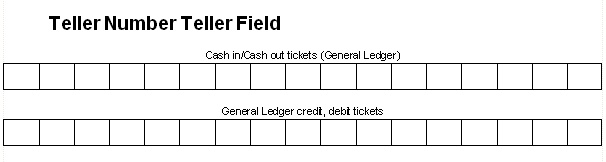

Tllr Nmbr |

This is the number of the teller that submitted this item for proof of deposit. The teller number is generally preprinted on cash-in and cash-out tickets. This is for information only. All transactions resulting from proof transactions will be run as teller 9999 along with the other afterhours processing. |

Trace Number |

This is the trace number of the item in the transmission. It is assigned during the proof processing before the transmission comes to GOLDPoint Systems. This allows the tracing of an item back to the original paper item from which it was generated. When finding a particular transaction on the account or amount order report, you can use this trace number to find all the tickets that were processed with the item you are researching. |

Totals Provided

The totals given for this report are the number and amount of the proof-of-deposit (POD) inclearings, the number and amount of the checks not on us, the debits and credits that resolved to transactions, the debits and credits that did not resolve to transactions, and the total debits and credits transmitted.

This table lists the proof and host transaction codes and the description of the transaction. These proof codes must be used for the transactions sent in the batch.

Proof Code - Credits |

Tran Code |

Description |

30 |

1810 |

General Ledger credit |

31 |

1120 |

Open deposit account |

32 |

1120 |

Deposit |

33 |

1710 |

Interest credit |

34 |

1130 |

Withdrawal correction |

35 |

1780 |

Miscellaneous credit (modifier) |

36 |

1230 |

Retirement distribution correction (modifier) |

37 |

1700 |

Federal withholding correction (modifier) |

38 |

1740 |

Penalty correction |

39 |

1730 |

Interest withdrawal correction |

40 |

1540 |

Cash out |

41 |

1220 |

Retirement contribution (modifier) |

43 |

1190 |

Close correction |

44 |

1290 |

Retirement close correction (modifier) |

45 |

580 |

Loan payoff |

46 |

830 |

Loan pay to zero |

50 |

650 |

Prepaid interest |

51 |

0438 |

LIP disbursement correction (modifier) |

52 |

0600 |

Loan payment |

53 |

0510 |

Loan field credit (modifier) |

54 |

0550 |

Late charge paid |

55 |

850 |

Pay loan fee |

56 |

688 |

Open loan correction |

57 |

0448 |

Reserve disbursement correction |

58 |

0570 |

Late charge waive |

59 |

Proof code credit transaction error (system-generated when proof is out of balance) |

Proof Code - Debits |

Tran Code |

Description |

00 |

1130 |

Withdrawal/Inclearing |

60 |

1800 |

General Ledger debit |

61 |

1400/02 |

On-us check (force pay) |

62 |

1120 |

Deposit correction |

63 |

1710 |

Interest credit correction |

64 |

1130 |

Withdrawal |

65 |

1750 |

Miscellaneous debit (force pay) (modifier) |

66 |

1230 |

Retirement distribution (modifier) |

67 |

1700 |

Federal withholding (modifier) |

68 |

1740 |

Penalty withdrawal |

69 |

1730 |

Interest withdrawal |

70 |

1550 |

Cash in |

71 |

1220 |

Retirement contribution correction (modifier) |

72 |

1130 |

Inclearing checks |

73 |

1190 |

Close deposit account |

74 |

1290 |

Retirement close (modifier) |

75 |

588 |

Loan pay-off correction |

76 |

838 |

Loan pay-to-zero correction |

79 |

868 |

Partial charge-off correction |

80 |

0658 |

Prepaid interest correction |

81 |

0430 |

LIP disbursement (modifier) |

82 |

0680 |

Open loan |

83 |

0500 |

Loan field debit (modifier) |

84 |

0558 |

Late charge paid correction |

85 |

858 |

Pay loan fee correction |

86 |

608 |

Loan payment correction |

87 |

0440 |

Reserve 1 disbursement (modifier) |

88 |

0578 |

Late charge waive correction |

99 |

Proof code debit transaction error (system-generated when proof is out of balance) |

Bank Proof Record Layout

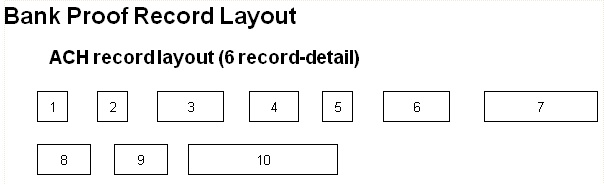

GOLDPoint Systems receives the POD transmission in the same way (record layout) as the standard Federal Reserve ACH format. The requirements for the record layout are detailed below:

1.Record type = “6” (length - 1)

2.Transaction code = 2 digit proof code (length - 2)

3.Routing and transit number = 8 digits + 1 check digit (length = 9)

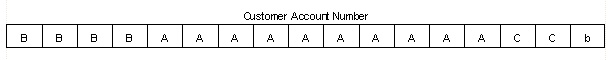

4.Account number (length 17 digits)

Format to the General Ledger account number structure in General Ledger setup. Should be right justified with blanks (b) separating the account number structure.

Right justified with leading 0 or “b.”

•0 - Zero fill

•B - Branch

•A - Account number

•C - Check digit account number, cost center — General Ledger

•b - blank spaces

The 0 (zero fill) and the b (blanks) do not need to be encoded on the tickets. However, GOLDPoint Systems must receive them in the POD transmission. Work with your processor to determine how they will send this information.

5.Transaction amount (length - 10) ![]()

This field is right justified with 0 fill. This will need to be encoded by your processor.

6.Individual ID — (length - 15) (0 fill) — see Customer ID field information. GOLDPoint Systems uses this field for:

a.Transaction modifiers

These codes need to appear in layout positions 44 and 45.

b.Transaction descriptor

These codes need to appear in layout positions 44, 45, 46, and 47. (A modifier will not be used.)

c.Retirement distribution code

These codes need to appear in layout positions 46 and 47.

d.Inclearing on-us check — check numbers

This number needs to appear in layout positions 40-47. You will need to work with your processor on how to receive this in order to do proper encoding.

7.Individual name (length - 22) Four-digit teller number (positions 55-58) with 0 fill.

8.Discretionary data (length - 2) Used for uncollected funds indicator:

a.0 - No hold

b.01 - Local

c.02 - Non-local

These codes need to appear in layout position 77 and 78. Your processor must receive this field as 01 or 02. This field should only be sent on not-on-us checks. Your processor determines by the checks’ routing and transit numbers if the hold is local or non-local. The processor then assigns the code in this field. All not-on-us checks are assigned an uncollected funds hold.

9.Addendum record indicator — (length - 1) = 0

10.Trace number — (length - 15). Right justified, 0 fill. Your processor will encode this.

Customer ID Field

The Customer ID field, in the POD transmission, contains additional transaction information. This is used for retirements, Reg DD, check numbers, and transaction selection. The Customer ID field is position 40-54 (15 length) of the "6" detail record.

Format Breakdown

1.Inclearing checks — the check number — (position 40-47)

2.Transaction code modifier — (position 44, 45) — used with tran codes with multiple modifiers; for example, 1220 (open retirement account) and 1220/01 (open for prior year), etc.

3.Transaction descriptor — (position 44, 45, 46, 47) — modifier field not used with descriptor. This field is used for up to a 4-digit descriptor code to allow proper descriptions in history for miscellaneous debits and credits.

4.Retirement distribution code — (position 46, 47) — used with 44 and 45 as transaction code modifiers.

Proof Code Breakdown

Credits

•35 - Descriptors

•36 - Modifier and retirement distribution code

•37 - Modifier

•41 - Modifier

•44 - Modifier and retirement distribution code

Debits

•65 - Descriptors (force pay)

•66 - Modifier and retirement distribution code

•67 - Modifiers

•71 - Modifiers

•74 - Modifiers and retirement distribution code

•00 - Inclearing check

•61 - On-us check (force pay)

•72 - Inclearing check

Distribution Codes

The following is a list of proof IRA distribution codes by their corresponding IRS distribution codes. The valid types are:

•QUAL Qualified Plan

•ROTH Roth IRA

•ESA Coverdell Education IRA

•SIMP Simple IRA

Distribution Code |

Proof Code |

Description |

Valid Type |

1 |

01 |

Premature distribution |

TRAD, SIMP, QUAL, ESA |

2 |

05 |

Premature with exceptions |

TRAD, SIMP, QUAL, ESA |

3 |

09 |

Disability distribution |

TRAD, SIMP, QUAL, ESA |

4 |

13 |

Death distribution |

TRAD, SIMP, QUAL, ESA |

4A |

14 |

Death/10-year distribution |

QUAL |

4G |

34 |

Death/direct roll IRA |

TRAD, SIMP, QUAL |

5 |

43 |

Prohibited transactions |

All IRA plans |

5J |

44 |

Prohibited/no exceptions |

ROTH |

7 |

17 |

Normal distribution |

TRAD, SIMP, QUAL |

7A |

18 |

Normal distribution/10-year tax option |

QUAL |

8 |

21 |

Current year excess contribution |

TRAD, SIMP, QUAL, ESA |

81 |

45 |

Current year excess under 59 1/2 |

TRAD, SIMP, QUAL, ESA |

82 |

46 |

Current year excess |

TRAD, SIMP, QUAL, ESA |

84 |

47 |

Current year excess/death |

TRAD, SIMP, QUAL, ESA |

8J |

53 |

Current year excess/no exceptions |

ROTH |

10 |

32 |

Current year interest excess |

All IRA plans |

11 |

33 |

Prior year interest excess |

All IRA plans |

D |

22 |

Prior year excess |

TRAD, ROTH, ESA |

D1 |

60 |

Prior year excess/premature |

TRAD, SIMP, ESA |

D2 |

61 |

Prior year excess/premature |

TRAD, SIMP, ESA |

D4 |

62 |

Prior year excess/premature |

TRAD, SIMP, ESA |

E |

23 |

Excess additions |

TRAD, ROTH, ESA |

G |

24 |

Direct rollover to IRA |

TRAD, SIMP, QUAL |

J |

27 |

Early distribution from ROTH IRA, no known exception |

ROTH |

N |

48 |

Recharacterized IRA contribution made for current year |

TRAD, SIMP, ROTH |

P |

26 |

Prior year excess |

TRAD, ROTH, ESA, QUAL |

P1 |

50 |

Prior year excess under 59 1/2 |

TRAD, SIMP, QUAL |

P2 |

51 |

Prior year excess |

TRAD, SIMP, QUAL |

P4 |

52 |

Prior year excess/death |

TRAD, SIMP, QUAL |

PJ |

54 |

Prior year excess/no exception |

ROTH |

Q |

64 |

Prior year excess/qualified ROTH |

ROTH |

R |

39 |

Recharacterized IRA contribution for prior year |

TRAD, SIMP, ROTH |

S |

31 |

Early distribution |

SIMP |

T |

49 |

Roth IRA distribution exception |

ROTH |