Navigation: GOLD Services Screens > General Ledger Screen Group >

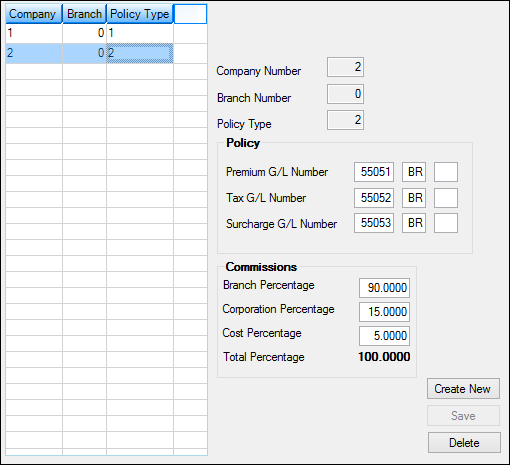

The Setup G/L and Commissions screen is used to set up and store insurance General Ledger numbers and commission percentage information. Once the information is entered on this screen, when insurance policies are created either through the Loans > Insurance screens or GOLDTeller insurance transactions, the premiums, surcharges, and taxes involved with those insurance policies will be credited (or debited) in the General Ledger accounts you set up on this screen.

GOLD Services > General Ledger > Setup G/L and Commissions Screen

This screen allows a General Ledger number to be assigned by insurance policy type, plus either the insurance company number or the institution branch number. If an insurance rebate is due back to the customer when the account pays off, the program will pull the General Ledger number from this table and automatically display it on the Loans > Payoff screen.

Additionally, the Commissions field group allows you to enter which percentage of the premium on new insurance policies goes to commissions, and how that commission is broken down among the branch, corporation, and cost. These percentages are set up according to the insurance policy type plus either the insurance company number or the institution branch number. Commissions can be amortized and automatically posted to the General Ledger on a monthly basis. (This is similar to how deferred fees, costs, etc. function). Update function 80 must be set to “CYC31B” to amortize the commissions properly. The monthly amortization uses transaction codes 100 (commission debit) and 110 (commission credit). The commission amortization uses the term and the amortization method of the insurance. Insurance commissions will not amortize if certain conditions exist on the loan. See below to view a list of these conditions.

|

General Ledger accounts must already be set up in the General Ledger before they can be entered on this screen. The system will return an error provider ![]() if the General Ledger account is not already on the system. For more information on setting up General Ledger accounts, see section 3.5.1, Single Account, or section 3.5.2, Multiple Accounts, for more information. General Ledger setup may also require the assistance of your institution's GOLDPoint Systems account manager.

if the General Ledger account is not already on the system. For more information on setting up General Ledger accounts, see section 3.5.1, Single Account, or section 3.5.2, Multiple Accounts, for more information. General Ledger setup may also require the assistance of your institution's GOLDPoint Systems account manager.

The main function of this screen is to set up Insurance policy types with applicable General Ledger accounts. See below for more information about this process. Also see help on the Loans > Insurance > Policy Detail screen.

|

See Setup G/L and Commissions fields for more information about the fields on this screen.

|

GOLDPoint Systems Only: Imbedded in tran codes 100 and 110 is the insurance type. The “branch” and “corporate” commissions use amount field L-22 (credit) and posting field 23 (insurance policy type) during the amortization transaction, while the "cost" uses amount field L-23 (debit) and posting field 23 (insurance policy type). Be sure the G/L Autopost is set up to handle this transaction. |

|---|

See also:

General Ledger Autopost Overview

|

Record Identification: The fields on this screen are stored in the FPID record (Insurance GL Account ID). You can run reports for this record through GOLDMiner or GOLDWriter. See FPID in the Mnemonic Dictionary for a list of all available fields in this record. Also see field descriptions in this help manual for mnemonics to include in reports. |

|---|

In order to use this screen, your institution must:

•Subscribe to it on the Security > Subscribe To Mini-Applications screen.

•Set up employees and/or profiles with either Inquire (read-only) or Maintain (edit) security for it on the CIM GOLD tab of the Security > Setup screen.

•Set up the desired field level security in the FPID record on the Field Level Security screen/tab. |