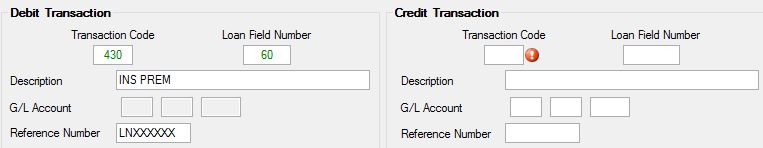

See the table below for information about the fields in the Debit and Credit Transaction field groups on the GTPC Funding Rules screen. See the main screen help for more information about funding rules.

These field groups have identical field names and are generally used together.

The fields in this field group are as follows:

Field

|

Description

|

Transaction Code

Mnemonic: AFTRAN

|

The Debit and Credit Transaction Code fields allow you to enter a transaction code for the type of transactions the funding rule should process. You will generally need to enter transaction codes in both the Debit and Credit fields. The debit transaction will be offset automatically by a journal out and the credit transaction will be offset by a journal in. See below for more information.

A complete listing of transaction codes can be found in Appendix D of the GOLD Services manual in DocsOnWeb. The following is a partial list of transaction codes you may want to set up as funding rules. Not every institution uses the same transactions to open a loan; thus, all the transactions you require cannot be listed. Consult a loan specialist within your institution, or contact your GOLDPoint Systems account specialist for more details about the types of transactions needed to fund new loans.

Tran #

|

Description

|

680

|

Open New Loan

|

510

|

Field Credit to Reserve 1 Balance using field 62

|

510

|

Field Credit to Reserve 2 Balance using field 71

|

650

|

Prepaid Interest

|

510

|

Field Credit to LIP Balance using field 98

|

510

|

Field Credit to LIP Customer Balance using field 99

|

1800

|

General Ledger Miscellaneous Debit

|

1810

|

General Ledger Miscellaneous Credit

|

430

|

LIP Disbursement

|

In the example below, the Open New Loan transaction (tran code 680) is offset by a Field Credit transaction (tran code 510) to the LIP undisbursed balance (field 98).

|

Note: The first funding rule number in every rule set must be the Open New Loan transaction (tran code 680) in order to facilitate funding of the loan.

|

|

|

Loan Field Number

Mnemonic: FNFLD# and AFFLD#

|

See below for more information about the three main uses of this 5-digit numeric field.

1.This field is used to identify which field in the Loan system should be posted to for the transaction code specified. Specific field numbers, when used with certain transaction codes, have been programmed to translate into designated loan fields. Not all transaction codes require field numbers in order to post to loan amount fields (for example, tran codes 580 and 680 will automatically affect the principal balance and do not need to be designated with a field number to direct amounts to the principal balance field in the Loan system). However, some transaction codes must have a field number in order to identify which amount field in the Loan system should be affected (such as tran codes 500 and 510 which are simply field debits and credits). | For example, in the screen example below, "98" is entered in the Field Number field for transaction code 510. This translates into an increase (credit) to the LIP balance, found in the Undisbursed Balance field (LNLBAL). For a list of the field numbers, which loan amount fields they translate to, and their associated transaction codes, see GOLDTrak PC Field Numbers. |

| 2. | The second use for this field is to describe the purpose of the LIP disbursements (tran code 430). There is a list of predefined disbursement codes set up on the Loans > System Setup Screens > Construction Budget Descriptions screen. |

| 3. | The third use for this field is to identify which bank account number should be posted to for the Check Printing and Voiding funding rules. This is only necessary if your institution uses Posting Field 29 (Bank Account Number) in the organization options GLLN, GLDP, or GLOT. The Bank Account Number helps determine which Check Issued Account should be posted to for the type of check being processed. |

|

|

Description

Mnemonic: AFTDSC

|

In this field, enter a brief description of this transaction. The description will also follow the transaction to the General Ledger. When G/L debit and credit transactions are performed through the funding rules, the description entered here will be passed to the General Ledger Autopost Resolution Detail Report (FPSDR205), and to the G/L history, if the Autopost parameters are not summarized for the G/L Autopost Recap Report (FPSDR016).

|

G/L Account

Mnemonic: N/A

|

Use this field to enter a General Ledger account number for this funding rule. A G/L account number can only be input if you have specified an 1800 or 1810 transaction code (G/L debit or G/L credit). This field matches the format of the G/L account structure set up by your institution within the General Ledger system. As you fill in each of the sub-fields of the G/L account number with the maximum number of characters, the cursor is automatically tabbed to the next field. The system will return an error provider  if the account number you enter is not found or inactive in the General Ledger system. if the account number you enter is not found or inactive in the General Ledger system.

You can use parameter substitutions in the G/L account sub-field. See Parameter Substitution for more information.

|

Reference Number

Mnemonic: AFREF#

|

Whatever data is entered in this 8-character field will be assigned to the teller transaction in the Reference Number field. Additionally, this data will be sent to the General Ledger history in the Reference Number field if no summarization is requested through the G/L Autopost Recap Report (FPSDR016). The default entry in this field is "LNXXXXXX." This entry will automatically place the loan account number into the G/L Reference NBR field. In addition, "LNXXXXXX" on G/L debit and credit transactions (tran code 1800/1810) will carry the loan account number to the General Ledger Autopost Resolution Detail Report (FPSDR205).

|