Navigation: GOLD Services > GOLD Services Screens > General Ledger Screen Group >

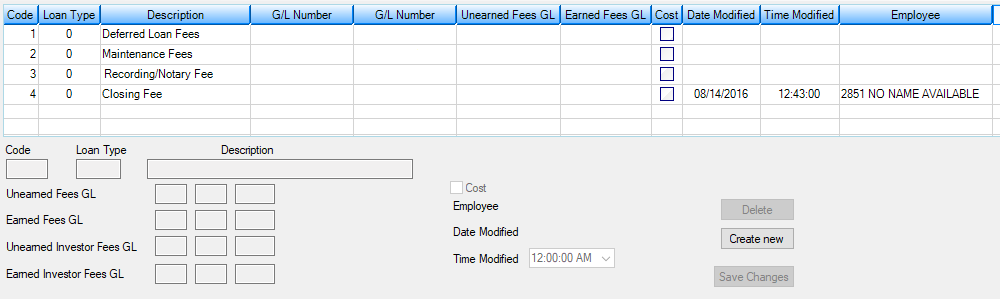

The Amortization Descriptions screen is used to set up institution-defined amortizing fee codes, descriptions, and General Ledger account numbers to be used with those codes. After fee code numbers and descriptions have been set up on this screen, you would then enter the applicable code on individual loans using the Loans > Account Information > Amortizing Fees and Costs screen. Once the codes are entered on the loan, the description will appear on screens and reports. This is an administrative screen and access to it should be limited.

This screen appears in CIM GOLD under GOLD Services > General Ledger as well as Loans > System Setup Screens. See Amortization Descriptions Fields for more information about the fields on this screen.

Clicking on an item in the list view will cause its information to be displayed in the detail fields below.

•To add an amortizing fee code, click <Create New> and enter new information in the Code, Description, and G/L Account Numbers fields. Check the Cost box if this is a cost G/L number you are setting up.

•To delete an amortizing fee code, highlight the item in the list view and click <Delete>. When you are finished making changes, click <Save Changes>.

|

WARNING: Once a fee code and description have been assigned, they should not be changed. When a fee code has been assigned to a loan, that code is stored on the loan record but the description is not stored. Upon accessing the screen, the program uses this table to look up the description. An incorrect description would be displayed if the description has been changed. |

|---|

|

Note: This screen is used in connection with the loan-level Loans > Account Information > Amortizing Fees and Costs screen. The Amortizing Fees system is not the same as the Deferred Fees system, which most institutions would use. The Amortizing Fees and Costs screen would be used, for example, if you are refunding (rebating) some or all fees to the borrower at time of payoff. |

|---|

The Amortizing Fees system gives your institution the ability to track individual fees that are assessed as part of loan origination. Fees can be amortized (using several methods) and taken to income over the term of the loan. In addition, fees can also be refunded (rebated) to the borrower at payoff.

Three different afterhours reports (FPSRP226) provide trial balances, a posting journal of G/L fields, and a journal of the fees that were amortized to the G/L. For more information about these afterhours reports, please refer to the Loan Reports manual in DocsOnWeb.

Options

Afterhours function 87 must be turned on for the fee amortization to process. This would generally be set to process at monthend.

The amortization is processed by a 451 mod 1 transaction. This is an afterhours only transaction and cannot be processed online in the GOLDTeller system.

OP01 DFAM will amortize only up to the month of the due date. If a loan is delinquent and one or more payments are made, amortization will only occur for the months for which the payments were made, possibly leaving the date last amortized in the past.

Example: A loan has a due date of 6-15 with a payment frequency of 1. It will amortize at 6-30 up to 5_31. (It will only amortize for the loan payments that have been paid.)

Action code 39 will stop amortization up to the action date.

If Option COOP is not set, normal amortization will occur.

If Option COOP is set (greater than zero) and the general category is 80-89, the amortization will take all the remaining fee the month the loan is charged off and the general category is changed to 80-89. For more information concerning the charge-off options (COOP), see the Charge-off transaction documentation.

Also see the following amortization options (AMOP) for additional options affecting amortization of costs/fees:

|

|

Note: Fees will not amortize if any of the following conditions exist on the loan:

1.If the loan is non-performing (LNNONP = Y).

2.If General Category is "80" or greater on the Loans > Account Information > Account Detail screen.

3.The Asset Classification on the Loans > Account Information > Additional Loan Fields screen is set to "Doubtful" or "Loss."

4.If this is a line-of-credit loan (payment method 5) with a zero balance. |

|---|

See also:

General Ledger Autopost Overview

|

Record Identification: The fields on this screen are stored in the FPF2 record (Amortizing Fee Descriptions). You can run reports for this record through GOLDMiner or GOLDWriter. See FPF2 in the Mnemonic Dictionary for a list of all available fields in this record. Also see field descriptions in this help manual for mnemonics to include in reports. |

|---|

In order to use this screen, your institution must:

•Subscribe to it on the Security > Subscribe To Mini-Applications screen.

•Set up employees and/or profiles with either Inquire (read-only) or Maintain (edit) security for it on the CIM GOLD tab of the Security > Setup screen. |