Navigation: CIM GOLD What's New > What's New in Version 7.20.7 >

Enhancement |

Description |

|---|---|

Customer Directed Transfers Sweeps Allowed for ACH to External Deposit Account

CMP: 16424 - This release is compatible with core services CMP 15054, which is part of the 20200701 host-release (August 2020).

CIM GOLD version 7.20.7 |

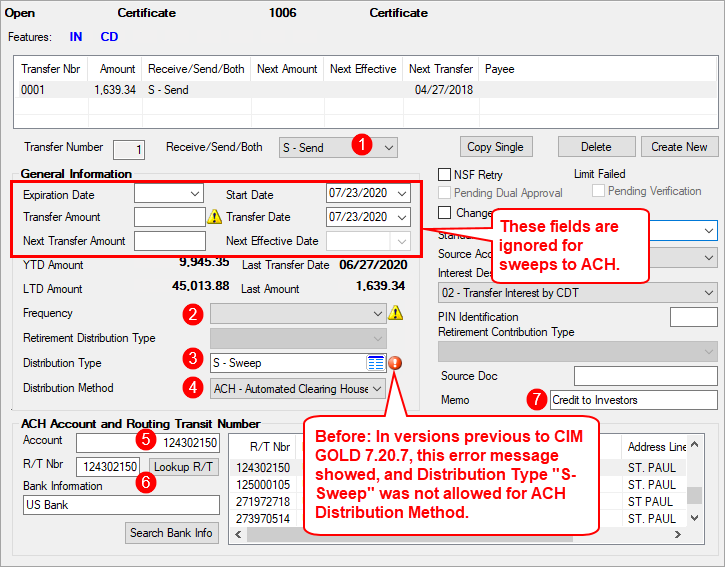

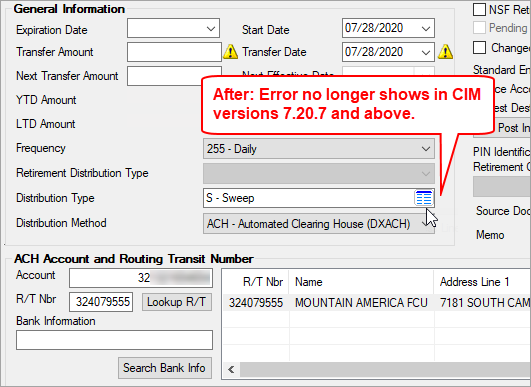

We have added the ability to create Customer Directed Transfer (CDT) sweeps to an external account using ACH. Currently, if users attempt to set up Customer Directed Transfers using Distribution Type "S – Sweep" with Distribution Method "ACH," an error shows saying that is not allowed. See before and after examples below.

This is needed for one institution who works with investor-backed loans, and the investors request loan payments be deposited into their preferred banking accounts. This is called a custodial account and is set up on the Loans > Investor Reporting > Investor Group screen > Custodial Accounts tab.

For this function properly, the following fields must be set up on the deposit account using the Deposits > Account Information > Additional Fields screen:

•Minimum Balance Limit (DMMNBL): This field designates the minimum amount of funds that will initiate the sweep. For example, if you want to ensure that at least $100 is always in the deposit account, and anything above that amount can be swept to an external bank account, you would enter “100.00” in this field. If this field and the Maximum Sweep Balance field are zero, all funds in the Current Balance of the deposit account are swept to the external account.

•Maximum Sweep Balance (DMMXBL): This field indicates the maximum amount of funds to transfer to the external account. For example, if the Maximum Sweep Balance is 10,000.00, and the Current Balance on the account is 12,000.00, when the CDT transfer occurs, the system will only move 2,000 and leave 10,000 in the account.

•If Maximum Sweep Balance is not zero and the Current Balance is more than the Maximum Sweep Balance, the sweep amount will be: Current Balance – Maximum Sweep Balance.

•If the Maximum Sweep Balance is zero and Minimum Balance Limit is greater than zero, with the Current Balance greater than Minimum Balance Limit, then the sweep amount is: Current Balance – Minimum Balance Limit.

•Sweep Funds Out (DMSWPO): This option must be checked.

•Never Automatically Close Account (DMNACL): This field must be checked.

Users will then set up the Customer Directed Transfers screen to include the following information. This setup process will only work if using CIM version 7.20.7 and above. Do not attempt to set up these options in a version lower than 7.20.7.

1.The Receive/Send/Both drop-down field must be set to "Send" (DXGO = "Y").

2.The Frequency field should be blank. The system will transfer the funds daily when the Current Balance is more than the Minimum Balance Limit, but the Transfer Date (DXDTNP) field will not be updated if the Frequency is set to blank instead of daily (225). That field should not be updated in these cases. (The transfer occurs when the account balance exceeds the set limit.)

3.Distribution Type field (DXTPC1) must be set to "S – Sweep."

4.Distribution Method must be set to "ACH – Automatic Clearing House (DXACH)."

5.The account number of the external bank must be entered in the Account number field (DXCTAC).

6.The routing transit number of the external bank account must be entered in the R/T Nbr field (DXCTRT).

7.You don’t need to enter a memo in the Memo field, the system will discard it when the ACH batch is transmitted.

CDT Transfer Transaction

When the system sends CDT transfers in the afterhours, it uses tran code 1130-02. This isn’t a transaction you’ll find in CIM GOLDTeller. This is a behind-the-scenes transaction. This transaction does the following:

•This transaction will generate the ACH transfer and update the CDT fields only when the withdrawal is successful.

•The system will use deposit TORC 341 (Automatic Withdrawal to External Destination) for this transaction.

•The combination of the Send (DXGO = Y), Sweep (DXTPC1 = S), ACH (DXACH = Y), and Sweep Funds Out (DMSWPO = Y) will initiate the 1130-02 transaction to run in the afterhours, as well as the following.

•The transfer transaction amount sent to the external bank account will be the amount greater than the Minimum Balance Limit or greater than the Maximum Balance Limit, as described above. If those fields are blank, the entire Current Balance amount will be zeroed and transferred to the external account.

Afterhours Update Function

The process is initiated by afterhours update function 46 (Sweep Account Processing) in the deposit afterhours. Your GOLDPoint Systems account manager will set up that option to run "NXTDAY." The process is done today for tomorrow’s totals at the end of afterhours.

The following example shows the important fields on the Customer Directed Transfers screen that must be set up in order to sweep funds to an external account: |

Before: Deposits > Account Information > Customer Directed Transfers > Customer Directed Transfers Screen

After: Customer Directed Transfers Screen