Navigation: Miscellaneous Screens > Tables Screen Gorup >

Use this screen to view and enter tax rate table information for different insurance types, cities, counties, and states for use at your institution. Tax rate tables created on this screen will appear on the Miscellaneous > Tables > Tax Rate Table Summary screen. Double-click an item in the list view on that screen to open up this screen. When this screen is accessed in this manner, the list view on this screen displays all tax rate tables that have been set up for City/County combinations within the indicated State (see below).

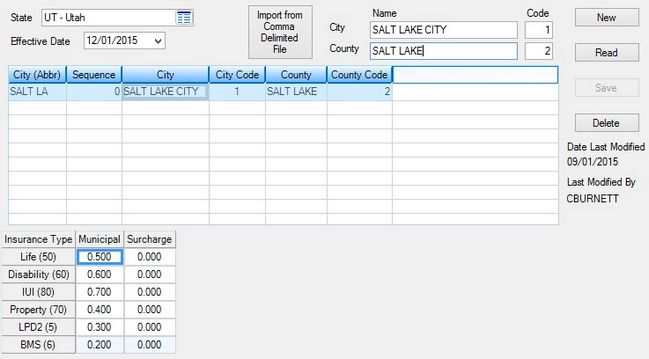

Miscellaneous > Tables > Tax Rate Detail Screen

To create a new tax rate table, click <New> and enter information in the fields on this screen. When <Save> is clicked, the new table will appear in the list view (and on the Tax Rate Table Summary screen). To edit an existing table, select an existing table in the list view and enter new information in the fields on this screen. When <Save> is clicked, the table's information will be updated. See below for more information about the fields on this screen.

Use these fields to indicate the following information for the table being created/edited on this screen:

•The State where the tax rate table is applicable (mnemonic TDSTAB).

•The Effective Date of the tax rate table.

•The City and County where the tax rate table is applicable. Use the adjacent Code fields to indicate institution-defined code numbers for the county and city (mnemonic TDCITC, TDCITY, TDCNTN, TDCNTY).

•Use the Insurance Type/Municipal/Surcharge table at the bottom of the screen to indicate municipal tax and surcharge rates for different insurance types on the tax rate table. Municipal rates are tax rates applied by the city, county, or state for that particular insurance type. Surcharges are extra charges (entered as percentages) applied by the insurer or local government. For example, a surcharge may be added by the city to property insurance to help pay for city improvements. Available insurance types are Life, Disability, IUI (involuntary unemployment), Property, LPD2 (limited property damage), and BMS.

The Date Last Modified and Last Modified By fields display the most recent date information was adjusted on the tax rate table as well as the username of the employee who made the adjustment. |

Tax rate tables can also be imported to this screen from comma-delimited files (such as .csv files). To do this, click <Import From Comma Delimited File> after indicating a State and Effective Date (see above). Once the file has been located on the user's computer and the system has successfully downloaded the file, click <Read> to refresh this screen and make the imported table.

|

Record Identification: The fields on this screen are stored in the CSTD record (Tax Rate Table Detail). You can run reports for this record through GOLDMiner or GOLDWriter. See CSTD in the Mnemonic Dictionary for a list of all available fields in this record. Also see field descriptions in this help manual for mnemonics to include in reports. |

|---|

In order to use this screen, your institution must:

•Subscribe to it on the Security > Subscribe To Mini-Applications screen.

•Set up employees and/or profiles with either Inquire (read-only) or Maintain (edit) security for it on the CIM GOLD tab of the Security > Setup screen. |