Navigation: Loans > Loan Screens > Statistics and Summaries Screen Group > Tax & Statistics Screen >

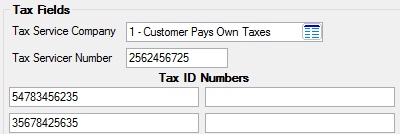

Tax Fields field group

Use this screen to view and edit tax data for the customer loan account.

The fields in this field group are as follows:

Field |

Description |

|

Mnemonic: LTSRCE |

Use this field to indicate the source of funds to be used for tax payments on the customer loan account. Possible selections in this field are shown below:

GOLDPoint Systems can accept tapes from Ticor and Transamerica for audits and tax disbursements as well as delinquency tapes from Transamerica. These records can then be attacked to the customer's profile. GOLDPoint Systems writes the customer name and address on to a new tape, which Transamerica then uses to produce delinquency mailers. |

|

Mnemonic: LTCNBR |

Use this field to indicate an account number used by the tax servicer for the customer loan account. Numbers and their formats are determined by Tax Service Companies. |

|

Mnemonic: LTID01-LTD10 |

Use these fields to indicate tax identification numbers used to identify the property associated with the loan. Up to ten tax ID numbers can be indicated in these fields. An example of a possible tax ID number is a property tax serial number. |