Navigation: Deposit Reports > Deposit Reports - Numerical Order >

Availability

This report is run in November on the October monthend every year as a test. On December 31st every year the report is run for IRS reporting deadlines. This report can be printed to paper and to GOLDView as per institution request on year-end letters.

Purpose

The 1099R Summary Report shows how the information on retirement accounts, their owners, and distributions made from those retirement accounts was sent to the IRS. This report can be sorted by short name or by Social Security Number (SSN). It lists one account per distribution code in summary form, printing the IRS owner's short name and Social Security Number. This report matches the 1099R forms.

Accounts will be excluded from the report if the account owner has an SSN/EIN type of 020, 021, 022, 120, 121, or 122 in theName/SSN/Citizenship type field (NDCTYP) on the Detailed Name Information screen (function 15/16) and the Household Names screen (function 13/14) in the CIF System (Application 9). In addition, 1099R forms will not print for these accounts.

Two "Copy C" forms will be printed—one for your institution and one for your customers. Two "Copy B" forms will be printed for each customer that had state and/or federal withholdings. These copies would be submitted with tax forms requiring those documents. For combined notices, the highest account number will be printed on the notice.

Report Column Information

See FPSDR152-2 Example for an example of this report.

Column |

Description |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

SSN# |

This column displays the Social Security Number of the person indicated by the IRS owner (MNSSFI). |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Account Number |

This column displays the account number associated with the account. It consists of the office number (DMACTO), account number (DMACTA), and check digit (DMCKDG). |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

IRS Owner |

This column displays the short name of the IRS owner associated with the account. It is taken from the CIF System (SHNAME). |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Dist Code |

This column displays the distribution code used for this distribution (DMDSCA). The following is a list of possible distribution codes:

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

YTD Distrib. with W/Hlding |

This column displays the year-to-date total of distributions and withholding made from this account (DMDSYD). |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

YTD Federal Withholding |

This column displays the year-to-date total of federal withholding for this account (DMDFWH). |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

YTD State Withholding |

This column displays the year-to-date total of state withholding for this account (DMSTWH). |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Type |

This column displays the type of retirement account. The retirement type can be found on the Retirement Fields screen (function 53/54). Valid types include IRA (DMRIRA), QRP (DMSTAR), SIM (DMSIMP), SEP (DMSEPP), ROTH (DMROTH), and ROL (DMCOND). |

Totals and Subtotals Provided

This report provides totals for the number of distributions, amount of federal withholding, amount of state withholding, and the total dollar amount of distributions including withholdings.

Totals are displayed on the last page of the report. See FPSDR152-2 Example for an example of this report.

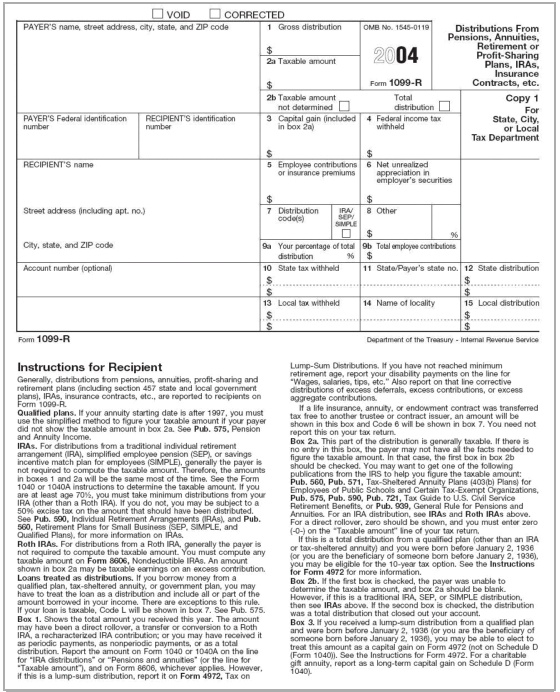

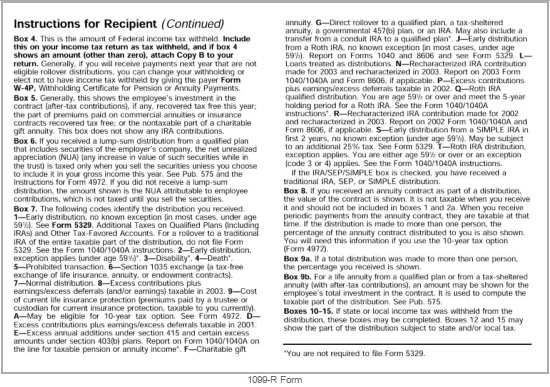

1099-R Form

The notice below is an example only. Please note that the form is subject to change based on federal regulation and may appear different from the one pictured. A statement sequence number will be printed at the end of the name line.