Navigation: Deposit Reports > Deposit Reports - Numerical Order >

Availability

The FPS/ATM Matching Report lists tranlog information and is therefore only available on a daily basis for online ATM processing.

Purpose

This report is designed to report automatic teller machine (ATM) transactions from online ATM processors that post to customers’ accounts in one of the following three ways:

1.Online at the time the transaction occurs at the ATM machine or at the merchant's location.

2.In the afterhours as part of store-and-forward ATM processing.

3.Through GOLD ExceptionManager (GEM) as a rejected item that gets posted.

These transactions are sorted by date and time within the cutoff period in which the transaction was processed by your ATM vendor.

This report is designed to match the ATM reports supplied by your ATM vendor.

An option is available to exclude rejects handled in the bottom cutoff totals on the report.

In order for this report to work correctly, it should be sorted first by cutoff period (84), second by date (81), and third by time (83).

|

GOLDPoint Systems Only: The cutoff time needs to be entered in the Misc Parm field (with the full time—e.g., 170000). This must be equal to the institution’s ATM cutoff time. Option SOFF must also be equal to the cutoff time. Option COFF should be equal to GOLDPoint Systems time.

Set Misc Opts 1 to skip batch transactions that do not have switch information.

Set Misc Opts 2 to exclude rejects handled in cutoff totals. |

|---|

Report Column Information

See FPSDR130 Example for an example of this report.

Column |

Description |

|---|---|

Account Number |

The office, account, and check digit are displayed here. Field lengths are controlled by institution options. |

Posted |

This is the method by which the ATM transaction was posted to the account. This will either be "ONLINE," "ST & FWD," "RJ," or "RJ HNDLR" for exception posting from GEM. |

Trans Date |

This is the actual switch date on which the cardholder did the transaction at the ATM terminal or merchant location for transactions posted "ONLINE" or "ST & FWD." |

Trn Time |

This is the actual switch time at which the cardholder did the transaction at the ATM terminal or merchant location for transactions posted "ONLINE" or "ST & FWD." |

Tran/Md |

The transaction code and modifier of the transaction are displayed here. If the transaction code is a 1900, with TORC 316, the transaction is a purchase authorization. |

TORC |

This is the Transaction Origination Code (TORC) by which the transaction was posted. This may be used to determine if a transaction was either done at an ATM machine or is a point-of- sale transaction. |

Orig |

The originating office of the transaction is displayed here. |

As-of Date |

If the transaction posted to the account is a different date than the "TRANS DATE," the as-of date will be displayed here. This will generally be blank for online transactions and for transactions posted through the reject handler, but will commonly be displayed on transactions posted through store-and-forward next day processing. |

Trans Amount |

This is the amount of the ATM transaction displayed with the appropriate sign. |

Transaction Description |

The terminal location for ATM transactions or the merchant name for point-of-sale transactions is displayed here. If this data was not given at the time of the transaction, then the default description for the transaction code and modifier will be displayed. |

Corr |

If the transaction was a reversal of a previous transaction, then the letters "CORR" will appear here. |

ATM |

This column displays whether an ATM transaction was performed "On Us" or on a foreign ATM. If it is an "On Us" transaction, an "O" will appear. If it is a foreign transaction, an "F" will appear. |

Report Column Information

In addition to the total transaction count, total debits and credits, and the net activity, a balancing total page is printed at the end of the report.

See FPSDR130 Example for an example of this report.

Column |

Description |

|---|---|

Date |

This is the date of activity within this cutoff. |

PRD |

This is the number of the cutoff period as shown in the report detail. "Reject" is always period 8, and "RJ Hndlr" is always period 9. |

TORC |

This is the Transaction Origination Code. |

Debit |

This is the total debit amount. |

Credit |

This is the total credit amount. |

Net |

This is the net amount of debits and credits. A minus following the number indicates a credit balance. |

After Switch Cutoff |

Since cutoff covers two days, this indicates that these totals are for after the cutoff for the previous day. |

Before Switch CUTOFF |

Totals for before the cutoff for the current day. |

FPSGOLD Cutoff |

The total posted to the accounts for the cutoff day given. |

Deluxe Cutoff |

The totals taken from the ATM activity report for the same cutoff. The message is shown if these totals were not available at the time this program was run. |

Difference |

The difference in the GOLDPoint Systems totals and the ATM totals. |

End-Point ID |

Totals taken from the ATM activity report, if they were available at run time. |

After P.M. Cutoff ... Previous Day |

Amounts posted to the G/L as part of the previous afterhours that are part of the current cutoff(s). |

Before P.M. Cutoff ... Current Day |

Amounts posted to the G/L with this afterhours for the current cutoff(s). |

After P.M. Cutoff ... Current Day |

Amounts posted to the G/L with this afterhours for the next cutoff. |

|

Note: If no ATM totals are available at the time this report prints, no terminal activity, cardholder activity, or G/L Reconciliation information will be shown.

|

|---|

Totals and Subtotals Provided

Subtotals and totals are provided in the following areas of the FPS/ATM Matching Report for terminal activity (debts and credits), cardholder activity (debts and credits), net fees, and net:

•Total Terminal Business Day

•Total Service Line Business Day

•Total New Suspense

•Total Previous Suspense

•Total Institution Business Day

These totals are pulled from the Recap section of the Deluxe ATM Report (FPDDSNJE). The Total Institution Business Day total is the sum of Total Terminal Business Day, Total Service Line Business Day, Total New Suspense, and Total Previous Suspense.

The G/L Reconciliation section of the FPS/ATM Matching Report displays totals based on the sums of the Total Terminal Business Day, Total Service Line Business Day, Total New Suspense, and Total Previous Suspense.

The G/L Clring Acct field displays the account number and balance of the G/L account. It also shows the resolved ATM activity for the current run date. The Automated Funds Movement Entry is equivalent to the Total Previous Suspense. The After P.M. Cutoff...Current Day field found in the G/L Reconciliation section is the net of the After P.M. Cutoff...Current Day field found elsewhere in the report. The Total New Suspense field in the G/L Reconciliation section is also the net of the Total New Suspense field found elsewhere in the report.

The Adjusted G/L Balance is the sum of:

•G/L Clring Acct

•Automated Funds Movement Entry

•After P.M. Cutoff..Current Day

•Total New Suspense

found in the G/L Reconciliation section of the report.

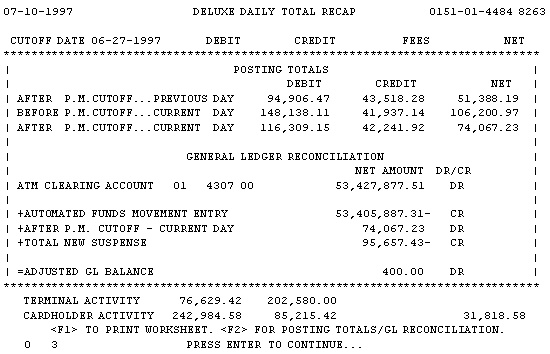

Daily Total Recap (F2 from ATM Comparative Totals screen)

The Daily Total Recap screen (Application 8, function 27, then <F2>) is used in conjunction with this report. Use the information on this screen, the GOLDPoint Systems Difference Detail Report, and the totals from the ATM Comparative Totals screen to reconcile your ATM accounts.

Your settlement periods are determined by how often your institution settles the ATM machines. If you run daily totals, your settlement period will be the preceding 24-hour period. If you run totals weekly, your settlement period will be for the preceding seven days. Deluxe cuts off ATM activity every 24 hours beginning and ending at 1700 hours Central Time. The period between your settlement and the Deluxe cutoff time is called the “suspense period.”

Cutoff Balances Dialog (F2 from Deluxe Daily Total Recap screen)

From the Deluxe Daily Total Recap screen, press <F2> to display a dialog with the balances you will need to certify the net general ledger activity to the FPS/ATM Matching Report. The total of the net column should equal the total transactions posted to the general ledger for that day.

The dialog is displayed over the Deluxe Daily Total Recap screen and appears as follows:

From this screen, you can also press <F1> to print a General Ledger Reconciliation Worksheet. This worksheet displays the same information found in the bottom half of the example above, followed by a section where you can list all adjustments (missed postings, double postings, etc.) needing to be made for a final balancing.