Navigation: Deposit Reports > Deposit Reports - Numerical Order >

This is the actual production of maturity notices, not the report. Maturity notices can be processed based on the options listed below. The Maturity Notices Report (FPSDR039) contains information on the accounts for the maturity notices that were printed. Please refer to that documentation for more information.

The Maturity Notices program checks all certificate accounts for maturity. Maturing accounts will have a maturity notice printed according to the following options, which are selected according to your institution’s needs.

The maturity notices are typically sorted in maturity date order, but can be sorted by any other standard sort.

An option is available to use the individual addresses and phone numbers of branches as return addresses instead of your institution’s pre-printed logo. The system pulls branch addresses from the GOLD Services > Office Information screen in CIM GOLD. In addition, an option is also available to align CIF data on the notice for viewing through a #10 double-window envelope.

The following documentation first details when maturity notices can be printed and then describes the fields shown on the notices. An example of the last option (16), printing information on the back of notices, is also shown.

|

GOLDPoint Systems Only: The CS record must be added to the Input Record if Deposits > Account Information > Roll Schedules screen > Certificate Rate and Term Schedule tab is being used.

This report can be sorted by mail code (90) and any other standard sort.

Insert the following alphanumeric codes in the Miscellaneous Parameter field to set certain options:

•“AN” - Enter these letters in positions 1 and 2 to print the anticipated balance. •“NOLOGO” - Enter these letters in positions 5-10 to print the institution’s branch return address and phone number in place of the logo. The address will be chosen based on the office of the account number (if the office is set up on the GOLD Services > Office Information screen in CIM GOLD). •“I0” - Enter this letter and number in positions 12 and 13 to align the CIF data on the notice for viewing through #10 double-window envelopes. |

|---|

Accounts are selected for maturity notice printing according to the following options. Only one of options 1-8 may be chosen by each institution per report. These options are set up by GOLDPoint Systems.

Option # |

Defintion |

|---|---|

None |

Maturity notices will be printed for all certificates that will mature in the month following the notice date. For example, if run on any day in September, maturity notices will be printed for all accounts maturing in October. |

1 |

Maturity notices will be printed for accounts maturing on days 1-15 of the following month. |

2 |

If the notice date is prior to the 15th of the month, maturity notices will be printed for accounts maturing from the 16th to the end of the current month. If the run date is after the 15th, then maturity notices will be printed for accounts maturing between the 16th and the end of the following month. |

3 |

Seven days are added to the notice date, and maturity notices are printed for accounts maturing between that date and the same date of the following month. For example, if run on September 3, then maturity notices for all accounts maturing between September 10 and October 10 will be printed. |

4 |

Seven days are added to the notice date, and maturity notices for accounts maturing between that date and the same day of the following week will be printed. For example, if run on September 3, then all maturity notices for accounts maturing from September 10 to September 17 will be printed. |

5 |

Fourteen days are added to the notice date, and maturity notices for accounts maturing between that date and the same day of the following month are printed. |

6 |

Fourteen days are added to the notice date, and maturity notices for accounts maturing between that date and the same day of the following week will be printed. |

7 |

Twenty-eight days are added to the notice date, and maturity notices for accounts maturing between that date and the same day of the following month will be printed. |

8 |

Twenty-eight days are added to the notice date, and maturity notices for accounts maturing between that date and the same day of the following week will be printed. |

9 |

Prints the notice date on the maturity notice. |

10 |

Prints the current balance, or the anticipated balance if the Miscellaneous Parameter field on the Report Setup Screen is set to "AN." Your GOLDPoint Systems client solutions specialist sets the report options for your institution. |

11 |

Prints the interest rate on the maturity notice. |

12 |

Prints the date the certificate was opened on the maturity notice. |

13 |

Prints the term and term type on the maturity notice. |

14 |

Prints the product code on the maturity notice. |

15 |

Moves information down two lines on the maturity notice. |

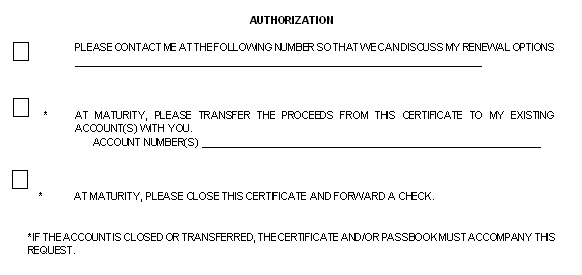

16 |

Tells printer to print 3 notices and then skip 3 pages to avoid printing over material on the back of previous maturity notices. This option is for notices with information on the back of the form. Using the back is optional and is for user-defined information. This option is only available with account number sort. |

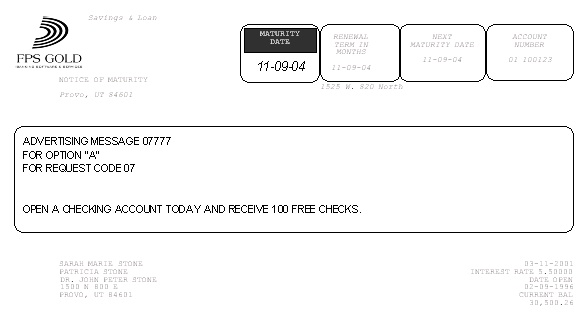

Front of notice

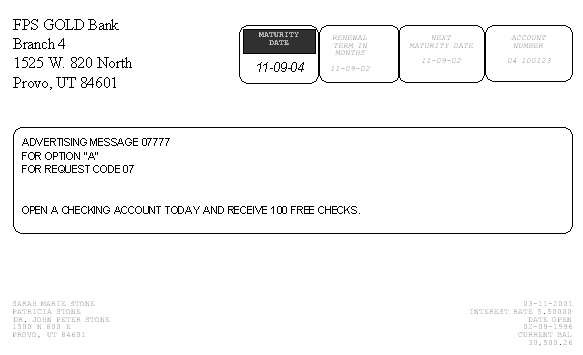

Front with options set to print individual branch addresses and #10 double-window envelope formatting.

Back of notice

Report Field |

Description |

|---|---|

Maturity Date |

This is the maturity date for this certificate account taken from the Maturity Date field (DMMTDT) on the Deposit Master Fields screen (function 1/2). |

Renewal Term and Type |

If this certificate account is automatically renewing, this field will contain the renewal term and type, which is displayed as "NNNX," where NNN is a number and X is one of the following codes.

D = Days M = Months Y = Years

Therefore, 180D would be 180 days, 36M would be 36 months, and 3Y would be 3 years. |

Next Maturity Date/or Product Code |

If this certificate is automatically renewing, this field will contain the next maturity date. This date is calculated from the maturity notice open and end date. If the certificate is not renewable, this field will be blank. If option 14 is on, the system will always print the product code in this field. |

Account Number |

This is the office number (DMACTO), account number (DMACTA), and check digit (DMCKDG) for this certificate account. |

Advertising Message |

A 60-character per line, 6-line space is available in which the institution can print any advertising message desired. Advertising messages are defined through the CIF System. |

Name & Address |

These are the mailing name and address for this account, taken from the CIF System. |

Notice Date |

This is the date on which this maturity notice was produced by the system. |

Interest Rate |

This is the current interest rate for this certificate account, taken from the Interest Rate field (DMRATE) on the Deposit Interest Fields screen (function 9/10). |

Date Open |

This is the date on which this certificate account was opened, taken from the Date Opened field (DMDTOP) on the Deposit Master Fields screen (function 1/2). |

Current Bal |

This is the current balance on this certificate account, taken from the Current Balance field (DMCRBL) on the Deposit Master Fields screen (function 1/2). If the Miscellaneous Parameter field is equal to "AN" on the Report Setup, this will be the anticipated balance (the sum of the current balance (DMCRBL), the accrued interest (DMACRI), and the computed return interest). |