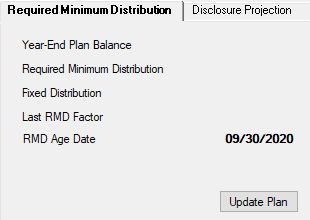

Navigation: Deposit Screens > Retirement Screen Group > Retirement Calculations Screen >

This tab displays the the Required Minimum Distribution (RMD) and related information for the customer account. This information is calculated using the account's Year-End Balance and current plan settings as established on the Deposits > Retirement > Retirement Plan screen.

Deposits > Retirement > Retirement Calculations Screen, Required Minimum Distribution Tab

The fields on this tab are as follows:

Field |

Description |

|

Mnemonic: N/A |

The total year-end balance of all accounts that are part of the retirement plan.

If you need to calculate the RMD based on a different year-end balance than what was in the system on December 31st, this value can be altered using the Year-End Balance field on the Retirement Fields tab of the Deposit > Account Information > Additional Fields screen. However, once the alternate RMD is calculated, the Year-End Balance field must be changed back to its original amount for proper use of the IRS 5498 form. |

|

Mnemonic: N/A |

The RMD amount for the customer account. All retirement distributions on the account must total at least this amount for the year. |

|

Mnemonic: RPFXDA |

The account's fixed distribution amount, if the account owner wants to use fixed distribution amounts instead of the calculated RMD amount. |

|

Mnemonic: N/A |

The required minimum distribution (RMD) factor amount. When an individual is taking distributions, the value in this field determines how much money must be distributed for the year. |

RMD Age Date

Mnemonic: WKDT07 |

The date the account owner reaches their eligibility for RMD. |