Navigation: Customer Relationship Management Screens > General Information Screen > Retirement Plans tab > Plan Fields tab >

Required Minimum Distribution Info field group

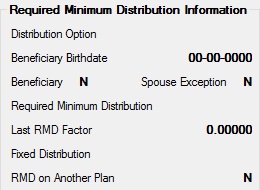

Use this field group to view and edit information about the customer retirement account's minimum distribution requirements (pertaining to the indicated household, if the household search field is in use).

The required minimum distribution (RMD) is the amount that Traditional, SEP and SIMPLE IRA account owners (as indicated in the Retirement Plan Type field group on the Deposits > Account Information > Additional Fields screen) and qualified plan participants must begin receiving distributions from their retirement accounts by April 1 following their 70 1/2 Date. The amounts must then be distributed each subsequent year.

The fields in this field group are as follows:

Field |

Description |

Use this field to indicate the type of distribution requested by the account's beneficiary. This field should read "0" (no option) until the death of the retirement plan owner, after which two options are available: "1" (5-year rule) or "2" (life expectancy). |

|

The birth date of the retirement plan beneficiary (if any). |

|

This field indicates whether the retirement plan designates a beneficiary. The status of this field affects RMD calculation. |

|

This field indicates whether the retirement plan designates a spouse exception. The status of this field affects RMD calculation. See the RMD Scenarios help page to learn more about the RMD scenarios available to use with retirement plans. |

|

This field indicates the calculated RMD annual amount for the account. When distributions are taken from the account, they must total at least the amount entered in this field for the year. An RMD is calculated based on the account features and birth date of the account owner.See the RMD Scenarios help page to learn more about the RMD scenarios available to use with retirement plans. |

|

This field indicates the RMD factor used in RMD calculation. |

|

This field indicates a fixed distribution amount used by the retirement plan. If the value in the RMD field is greater than the value in this field, this field will be ignored and the RMD amount will be used. |

|

This field indicates whether the account owner is taking the RMD from another plan. If a "Y" appears in this field, the RMD does not need to go into effect on this plan. |

Retirement plans are set up for customer accounts on the Deposits > Retirement > Retirement Plan screen.