Navigation: GOLD Services > GOLD Services Screens > Audit Confirmations Screen Group >

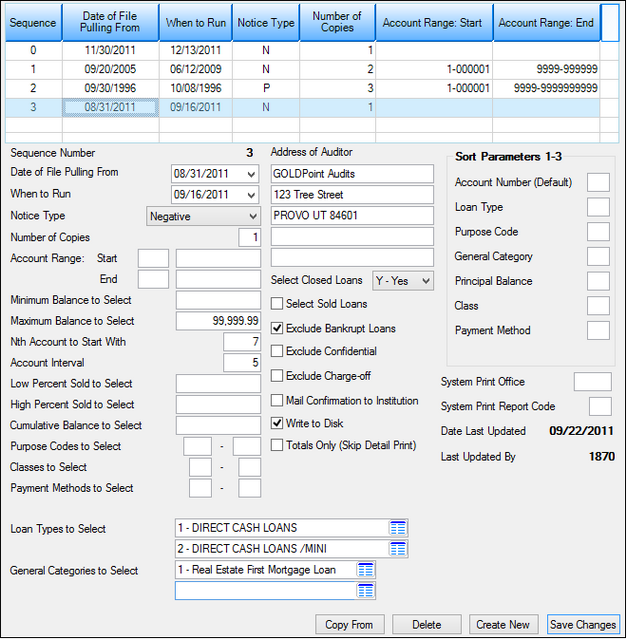

The GOLD Services > Audit Confirmations > Loan Audit Confirmation screen is used to set up audit confirmations for your institution’s loan accounts. The notices and reports generated using the options on this screen can be used for internal and third-party audits. You can process one third-party audit per year at no extra charge. Any others are billable to your institution.

Various options are used to make the account selections and create audit confirmation notices. Multiple confirmation setups can be kept on file for future use. The Audit Confirmation Report (FPSRP127) uses the information entered on this screen to create the notices and report. See the Reports and Notices section for more information.

|

Note: Institution Option 2 NTRT will display the effective loan rate on the notice (the rate which is currently in effect for the current loan due date). It will use the loan rate, LIP rate, or interest accrual rate for ARM loans (payment method 7). This option affects both loan and deposit notices. See Reports and Notices for examples of these notices sent to your customers. and deposit confirmation notices. The Print Rate on Notice box (see table below) will be checked if your institution uses this option. |

|---|

This screen allows easy entry of different selection criteria from which to select accounts for auditing. See below for more information.

The following steps describe the procedure used to run an audit confirmation for loans: |

||

|

||

|

||

|

||

These are the only required fields for running an audit confirmation. Once these fields have been filled in, the audit confirmation will run automatically in the afterhours, generating both a report for the institution and confirmation notices to be sent to your customers. |

||

|

||

|

||

|

||

|

||

|

GOLD Services > Audit Confirmations > Loan Audit Confirmation Screen

This list view at the top of this screen displays existing audit confirmation setups. Click on an item in the list to display the details in the fields below. You can then change some of the details for the selected setup. The fields and buttons on this screen are as follows:

Field |

Description |

||||||||

|

Mnemonic: CNCOPY |

This is the sequence counter of the audit confirmation setup records. This number is filled in automatically as each audit confirmation is set up. You can reuse confirmation records by updating dates on an existing setup. |

||||||||

|

Mnemonic: CNDTOF |

Enter the monthend date (MMDDCCYY) of the file that the audit is being run against. This is the date that will print on the confirmation notices (if notices are requested) unless Use Cycle Balance on Checking Accounts (below) is marked. This field will default to the most recent monthend date when a new audit confirmation is being set up.

|

||||||||

|

Mnemonic: CNRUND |

Enter the date on which you want the audit to run in the afterhours (MMDDCCYY). The default is today's date when setting up a new audit run. All dates are valid except Sunday and holidays. The file used will be the monthend date entered in the Date of File Pulling From field above.

|

||||||||

|

Mnemonic: CNFRMT |

Using the drop-down menu, enter either “Positive” for positive confirmations or “Negative” for negative confirmations. The default is “Negative.” |

||||||||

|

Mnemonic: CNCOPY |

Enter the number of copies of notices that you want generated for this audit confirmation. The default is one copy. If set to zero, only the report will be generated. |

||||||||

|

Mnemonics: CNBOFC,CNBACT, CNEOFC,CNEACT |

Use these fields to indicate the range of office and account numbers for which the audit is to be run. If the Start fields are left blank, the audit will begin with the first account on file.If the End fields are left blank, the audit will accept all accounts through the last account on file.

For example, if you enter a lower and upper range of 01-100000 to 06-199999, confirmations will be created for all accounts between the two ranges, not just accounts between ledger range 100000 to 199999 for branches 1 and 6. |

||||||||

Minimum/Maximum Balance to Select

Mnemonic: CNMINB, CNMAXB |

Use these fields to indicate the minimum and maximum account balance limits for which to create notices for accounts. The minimum value is -999,999,999.99. The maximum value is 999,999,999.99. If these fields are left blank, all notices will be printed regardless of balance. |

||||||||

|

Mnemonic: CN#SKP |

Enter the sequence of the account to begin the audit confirmation with. For example, when this field is 10, we will skip the first nine accounts that meet the other selection criteria and will accept the tenth account that meets it. If blank, the first account to meet the other selection criteria will be used. |

||||||||

|

Mnemonic: CNINTR |

Enter the sequential interval of accounts to select. For example, if this field is set to “5,” every fifth account to meet the other selection criteria will be used. If left blank, every account that meets the other selection criteria will be accepted. |

||||||||

Low/High Percent Sold to Select

Mnemonic: CNISLD, CNISL2 |

Use these fields to indicate the range of percent sold values by which to select loans for the audit. Only loans with a sold percentage within this range will appear in the audit. |

||||||||

|

Mnemonic: CNCUBL |

Enter the cumulative balance of accounts to select. For example, if $100,000.00 is entered, the account balances of all accounts meeting the other selection criteria will be totaled until this limit is reached. Once the cumulative balances total $100,000.00 or greater, the account in process at the time the limit is reached will be selected. The running total will then be reset to zero and the balances will begin to be totaled again. You cannot use this field if you are using account intervals (see above). |

||||||||

|

Mnemonic: CNPDCD, CNPDC2 |

Use these fields to indicate the range of purpose codes to select for the audit. Valid entries are 0 - 9999. If left blank, all purpose codes will be selected. |

||||||||

|

Mnemonic: CNBCLA, CNECLA |

Use these fields to indicate the range of class codes to select for the audit. Valid entries are 0 - 99. If left blank, all class codes will be selected. |

||||||||

|

Mnemonic: CNPMTH, CNPMT2 |

Use these fields to indicate the range of payment method codes to select for the audit. Valid entries are 0 - 99. If left blank, all payment method codes will be selected. |

||||||||

|

Mnemonic: CNDPTP, CNDPT2 |

Use these fields to indicate the range of loan type codes to select for the audit. Loan type codes are specific to your institution. |

||||||||

|

Mnemonic: CNGENL,CNGEN2 |

Use these fields to indicate the range of general category codes to select for the audit. Valid entries are 0 - 99. If left blank, all general categories will be used. |

||||||||

|

Mnemonic: CNLIN1–5 |

Use these fields to indicate the return address to appear on all confirmation notices. This is the name and address of the auditor for external audits, or the name and address of the branch or offices of your institution if an internal audit. This address is required. |

||||||||

|

Mnemonic: CNSLCL |

Use this field to control how and if closed loan accounts will be selected for the audit.

|

||||||||

|

Mnemonic: CNSLSL |

Use this field to indicate whether sold loans will be included in the audit. |

||||||||

|

Mnemonic: CNXBPT |

Mark this field to exclude loan accounts in bankruptcy from the audit. Accounts with “4” or “5” entered in the Hold Codes fields will be skipped when this box is marked. (The Hold Codes fields are found on many screens in CIM GOLD, including the Actions/Holds/Events tab on the Loans > Marketing and Collections screen.) |

||||||||

|

Mnemonic: CNXCNF |

Use this field to indicate whether confidential loans (statement cycle code 0) will be included in the audit. |

||||||||

|

Mnemonic: CNXCHO |

Use this field to indicate whether charged off loans will be included in the audit. Accounts with “82” entered in the General Category field on the Loans > Account Information > Account Detail screen will be skipped when this box is marked. |

||||||||

Mail Confirmation to Institution

Mnemonic: CNMCON |

Check this box to have the notices sent to your institution. If they are to go to your auditor, leave this field blank, and the address of the auditor must be entered in the Address of Auditor field on this screen (see above). |

||||||||

|

Mnemonic: CNDSKI |

Mark this field if your institution wants the audit to be written to a disk (file), so that disk can then be sent as a transmission to a third party. Any selection selection criteria you set on this screen are taken into account for the disk file. If you select this option, you need to contact GOLDPoint Systems to set up the accompanying transmission to the third party. |

||||||||

Totals Only (Skip Detail Print)

Mnemonic: CNSKPR |

Mark this field if you only want totals to be displayed on the report. The totals include the total principal balance of all loan accounts selected, and the total number of loan accounts included on the Audit Confirmation Report (FPSRP127). |

||||||||

|

Mnemonic: CNSBAC, CNSBAT, CNSBAB, CNSBGC, CNSBAF, CNSBCL, CNSBPM |

Use the fields in this field group to indicate audit sort priority values for certain account characteristics. Possible search priority values are 1-3. Account characteristics that are available to be assigned sort priority are Account Number (which is the default sort value for audits), Loan Type, Purpose Code, Principal Balance, General Category, Class, and Payment Method. |

||||||||

|

Mnemonic: CNOFF1 |

Enter the destination office number for system print reports. If left blank, the report will print at GOLDPoint Systems. |

||||||||

|

Mnemonic: CNRPCD |

Enter the system print report code destination for audit reports. Valid entries are: $, –, /, ., #, @, A–Z, and 0–9. |

||||||||

Date Last Updated/Last Updated By

Mnemonics: CNACTV, CNEMP# |

These fields are updated each time the audit confirmation setup is changed. These fields display the employee number of the person who last updated this confirmation setup as well as the date the update occurred. |

||||||||

<Copy From>

|

Use this button to simplify the setup of multiple audit confirmations. See below for instructions about copying a setup.

|

||||||||

<Delete>

|

Select an item in the list view and click this button if you want to delete the selected setup. |

||||||||

<Create New>

|

To create a new setup, click this button, then enter data in the fields on this screen. |

||||||||

<Save Changes> |

Click this button to save any changes you have made on this screen. |

|

Record Identification: The fields on this screen are stored in the FPCN record (Confirmation Notice). You can run reports for this record through GOLDMiner or GOLDWriter. See FPCN in the Mnemonic Dictionary for a list of all available fields in this record. Also see field descriptions in this help manual for mnemonics to include in reports. |

|---|

In order to use this screen, your institution must:

•Subscribe to it on the Security > Subscribe To Mini-Applications screen.

•Set up employees and/or profiles with either Inquire (read-only) or Maintain (edit) security for it on the CIM GOLD tab of the Security > Setup screen. |