Navigation: CIM GOLD What's New >

Welcome to What's New for CIM GOLD in version 7.21.7. This guide will help you understand all the changes and enhancements that are in the newest version of CIM GOLD. GOLDPoint Systems aims to make CIM GOLD the best servicing tool on the market. Please let us know if we can do anything to make it better.

While What's New releases are normally divided into multiple sections depending on the affected systems (GOLDTeller, Payment Calculator, Deposits, etc.), this release only contains a few changes and enhancements made to the Loans system. See the table below for further information.

Loans

Enhancement |

Description |

|---|---|

New Institution Option for Force Place Insurance

CMPs: 19820, 20060

CIM GOLD version 7.21.7

Note: This update requires the May 16, 2021 Production Release (Host Build 0401) to function properly.

|

A new institution option is available for streamlining the process of adding Force Place insurance to an account (from the Loans > Insurance > Force Place screen).

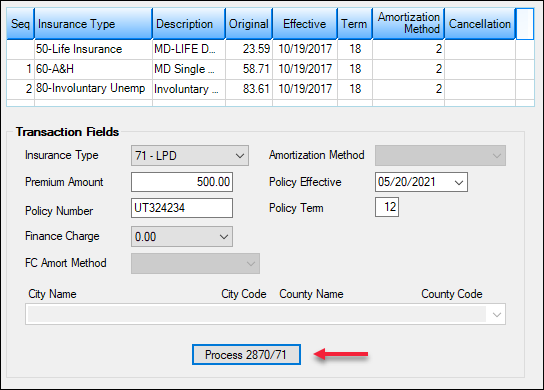

If OP33 CFPG (CIM Uses Force Place General Tran) is enabled at your institution, the insurance transaction used on the Force Place screen will default to always using tran code 2870-10 (Force Place General Transaction) regardless of the selected insurance type. This option changes the name of the <Add Insurance> button on that screen to <Process 2870/10>. Once users initially set up force-placed policy information on the Force Place screen and click <Process 2870/10>, tran code 2870-10 will open in GOLDTeller for processing. Note that this tran code is the preferred method for placing force-placed transactions on accounts.

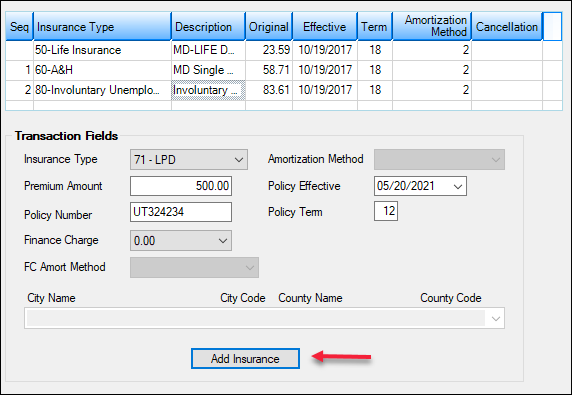

If this new institution option is not on, the Force Place screen will continue functioning as usual. In other words, each force-placed insurance transaction will process differently depending on which insurance policy is in use (if attempting to add insurance type 71 (LPD), then the Force LPD transaction (tran code 2870-71) will be used, for example).

Note: Tran code 2870-10 is connected to the Loans > System Setup Screens > Force Place Transaction screen. This screen allows default values to be entered for each insurance type and state (amortization method, company indicator, premium rate table, etc). For this new feature to work, you must ensure that the Force Place Transaction screen is set up with each insurance type and state used by your institution. Remember that the State used for insurance policies is the State code (LTSTCD) on the account, found on the Loans > Statistics and Summaries > Tax & Statistics screen. The State code is not the state in which the borrower resides, nor is it the Loan Classification field.

As part of this project, the FC Effective Date field has been removed entirely from the Force Place screen. If necessary (such as if the Effective Date needs to be different than the Policy Effective date), this field can still be manually edited for the transaction in GOLDTeller.

See the following screen examples below of what the Force Place screen looks like when the institution option is on and when it’s off. |

Loans > Insurance > Force Place Screen with Institution Option CFPG

Loans > Insurance > Force Place Screen without Institution Option CFPG

Enhancement |

Description |

|---|---|

New Card Payment Restrictions for High APR Loans

CMPs: 19729, 20063

CIM GOLD version 7.21.7 |

Worldpay no longer accepts card payments on loans with an APR (LNAPRO) of 30% or higher. Programming has been added to CIM GOLD to accommodate this new policy for all institutions who process card payments through Worldpay.

For institutions who use Worldpay, the EZPay screen has been programmed to disable the card payment option on all accounts with an APR greater than or equal to 30%. If Worldpay is your institution's only card processor, this means that only ACH payments will be allowed on those accounts.

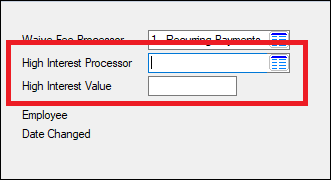

However, if your institution has access to other card processors that can accept high APR card payments, your GOLDPoint Systems account manager can use two new fields on the GOLD Services > Merchant ID screen to designate one of those other processors to use when an account's APR is 30% or above. These new fields (shown below) are as follows:

•High Interest Value: Use this field to indicate an APR value to designate as high interest. In the Worldpay example, this value will be 30, but this field allows for other values as well (to accommodate similar restrictions by other processors should the need arise). •High Interest Processor: Use this field to select one of the merchants set up for the institution (pulled from the main list at the top of the screen). Once the changes made to this screen are saved, the merchant selected in this field will be used to process all card payments for accounts with an APR greater than or equal to the High Interest Value.

Once a high interest processor has been designated at your institution, high APR card payments will be allowed in EZPay. Remember that the Merchant ID screen is not available to most users as of April 2021 and must be managed on behalf of your institution by your GOLDPoint account manger. Contact your account manager for more information about these enhancements. |

New High Interest Fields on the GOLD Services > Merchant ID Screen (GOLDPoint Systems Only)