Navigation: Deposit Reports > Deposit Reports - Numerical Order >

Availability

This report and the following notices are run in October each year as a test. On December 31st of every year the report is run for IRS reporting deadlines. This report can be printed to paper and/or GOLDView as per institution request on the year-end letters. The notices are either a multiple mailer or a substitute 8 ½" x 11" form.

Purpose

The 1099I notices are created for all accounts that have an amount in Year to Date Interest (DMIYTD) (Deposits > Account Information > Activity Information screen > Deposit Activity tab). If there are any exceptions, (for example, W8 on file, hold code 17, or invalid tax ID), they will be shown on the 1099I Exception Report as described below.

Your institution must choose either the 1099I mailer or the substitute form on the year-end letter. The 1099I Exception Report shows accounts that have exceptions. It is sorted by tax identification number (TIN), then by account number within each TIN. Exceptions are displayed in the last column under the heading cde. They are shown using a three-digit code.

The notices can be sent to a file that can be accessed by either the File Transfer Utility program or the FTP Web site. If this option is used, then no forms will be printed by GOLDPoint Systems. The file is the print lines of the alternate form; all the headings and verbiage that are printed on the form are sent in this file. If you would like to use this option, please send in a work order.

|

GOLDPoint Systems Only: If an institution would like all the notices in a file, then checkmark the create 1099I File (No Forms) field on the 1099I - Year-End Processing Screen (function 701/702) in GOLD Services (Application 8). In addition, the JCL must be set to “YREND.F” to copy the file to the BLOB. If the institution wants the file on the FTP Web site, then Operations must do a setup to copy the file from the BLOB to the FTP Web site. |

|---|

1099I Notice

See 1099I Notice Example for an example of the 1099I notice. The following institution options are available for the 1099-I notice. They must be indicated on your deposit year-end letter request form:

•Print 1099's for amounts greater than or equal to _________. This is an institution option. Programmers at GOLDPoint Systems will asign the amount your institution allows using institution option TNIL. The default is that accounts that earned interest of more than $10 will receive a 1099.

•Print separate 1099-I if address is different. This is an option your institution designates on the deposit year-end letter request form.

•Print balance and maturity date on alternate 1099-I. This is an option your institution designates on the deposit year-end letter request form.

•Print IRS owner only on 1099-I. This is an option your institution designates on the deposit year-end letter request form.

•Skip loan reserves for 1099-I reporting. This is an institution option that your institution selects on the loan year-end form (SKLR) .

•Skip contract collections for 1099-I reporting. This is an institution option that your institution selects on the loan year-end form (SKCC) .

Report Column Information

See FPSDR151 Example for an example of this report.

Column |

Description |

|||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

Account Number |

This column displays the account number for the account. It consists of the office number (DMACTO), account number (DMACTA), and the check digit (DMCKDG). |

|||||||||||||||||||||||||||||||||

Soc Sec Nbr |

This column displays the Social Security number or the Tax Identification number (TIN) of the IRS owner or organization associated with the account. |

|||||||||||||||||||||||||||||||||

Short Name |

This column displays the short name of the IRS owner associated with the account. It is taken from the CIF system (SHNAME). |

|||||||||||||||||||||||||||||||||

Rec Typ |

This column displays the record type associated with the account. Possible record types are contract collections (CCS), deposit (DEP), loan (LN), and loan reserve interest (LNS). |

|||||||||||||||||||||||||||||||||

Act Typ |

This column displays the activity type associated with the account. Interest (INT) is the only activity type possible. |

|||||||||||||||||||||||||||||||||

YTD Interest |

This column displays the amount of interest paid to the IRS owner this year for the account displayed (DMIYTD). |

|||||||||||||||||||||||||||||||||

YTD Penalty |

This column displays the amount of penalty paid by the IRS owner this year for early withdrawals from the account displayed (DMYTDP). |

|||||||||||||||||||||||||||||||||

YTD Withhold |

This column displays the federal tax amount withheld for the IRS owner for the account displayed (DMFDWH). |

|||||||||||||||||||||||||||||||||

Current Balance |

This column displays the current balance on this account. It is taken from the Current Balance (DMCRBL) field on the Deposits > Account Information > Account Information screen > Account Information tab. |

|||||||||||||||||||||||||||||||||

Maturity Date |

This column displays the maturity date (DMMATD), if any, for the account displayed. |

|||||||||||||||||||||||||||||||||

CDE (3-digit exception code) |

|

Totals and Subtotals Provided

This report provides totals for the number of accounts, year-to-date interest, year-to-date penalty, year-to-date withholding, combined account balances, and the number of closed accounts. The totals on this report do not include accounts with less than $10.00 in year-to-date interest. Accounts with less than $10.00 interest will only be included on this report if they also have other exclusions (e.g., W8 on file, 0 or negative interest, 1042-S on file, etc.) The total for accounts with less than $10.00 can be found on the 1099I IRS Tape Totals Report (FPS1099T) in the totals not sent column.

These totals are displayed on the last page of the report. See FPSDR151 Example for an example of this report.

Year-End Reports Balancing

Three separate reports are needed for balancing all year-end 1099 interest information. These reports are as follows:

1.One of the following: 1099I Customer Information Report, 1099I Numeric Listing, 1099I Alpha Listing, 1099I Social Security Report, or 1099I Social Security Address Report (FPSDR150).

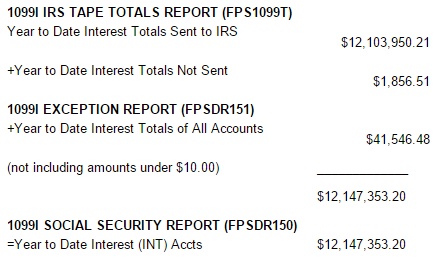

2.The 1099I IRS Tape Totals report (FPS1099T).

3.The 1099I Exception Report (FPSDR151). From these reports, the following totals should balance: The institution totals for interest, penalty, and withholding should match the Interest (Int) Accts fields on whichever 1099I report you choose from number one above (Customer Information, Numeric Listing, Alpha Listing, or Social Security).

The combined year-to-date interest of the Totals Sent to IRS, and the Totals Not Sent fields on the 1099I IRS Tape Totals report plus the institution totals in the Total of All Accounts field on the 1099I Exception Report should match theYear to Date Interest (INT) Accts field on whichever report you choose from number one above (Customer Information, Numeric Listing, Alpha Listing, or Social Security).

|

Note: You should also be able to balance these totals with the year-to-date total interest posted from the Deposit system. To do this, run Report Writer or GOLDWriter to pull in the total year-to-date interest using the Interest Earned Last Year field (DMYITL) on the Deposits > Account Information > Interest Fields screen,Interest Balance History field group. Run this on the live (online) set, not the monthend set. |

|---|

For further information on year-end balancing, please refer to the Deposit Year-End Manual in DocsOnWeb.