Navigation: Deposit Reports > Deposit Reports - Numerical Order >

Availability

This report is run in October every year as a test. On December 31st of every year the report is run for IRS reporting deadlines. This report can be printed to paper, and/or GOLDView as per institution request on year-end letters.

Purpose

The 1099I Social Security Address Report shows tax identification numbers (TINs) and the associated account(s) and name and address information. The report is sorted by tax identification number, then by account number within each tax identification number. Detailed information on interest, withholding, and penalty amounts for retirement accounts will print on this report. However, retirement accounts will not print a 1099I form or go to the IRS for reporting.

|

Note: FPSDR150 is used for year-end reporting. Five different reports are available depending on what type of sort you use. All of the reports do not have to be used. The 1099I Social Security Address Report (FPSDR150-4) is the fourth report available in the series. GOLDPoint Systems recommends using the 1099I Customer Information Report (FPSDR150-1) and at least one other report for research purposes. |

|---|

Report Column Information

See FPSDR150-4 Example for an example of this report.

Column |

Description |

Account Number |

This column displays the account number for the account. It consists of the office number (DMACTO), account number (DMACTA), and the check digit (DMCKDG). |

Soc Sec Nbr or TIN |

This column displays the social security number or the tax identification number (TIN) of the person indicated by the IRS owner (MNSSFI). |

Name and Address Information |

This column displays the names (MNNAM1, MNNAM2) and the mailing address (MNADD11) for the account. This is taken from the CIF System. |

City, State ZIP |

This column displays the city, state, and ZIP code (MNCSZP) for the account. This is taken from the CIF System. |

Totals and Subtotals Provided

This report provides totals for the number of accounts, year-to-date interest, year-to-date penalty, year-to-date withholding, combined account balances, the number of closed accounts, and negative interest set to zero. These totals are displayed on the last page of the report. See FPSDR150-4 Example for an example of this report.

Year-End Reports Balancing

Three separate reports are needed for balancing all year-end 1099 interest information. These reports are as follows:

1.One of the following: 1099I Customer Information Report, 1099I Numeric Listing, 1099I Alpha Listing, or 1099I Social Security Report (FPSDR150).

2.The 1099I IRS Tape Totals report (FPS1099T).

3.The 1099I Exception Report (FPSDR151). From these reports, the following totals should balance: The institution totals for interest, penalty, and withholding should match the Interest (Int) Accts fields on whichever 1099I report you choose from number one above (Customer Information, Numeric Listing, Alpha Listing, or Social Security).

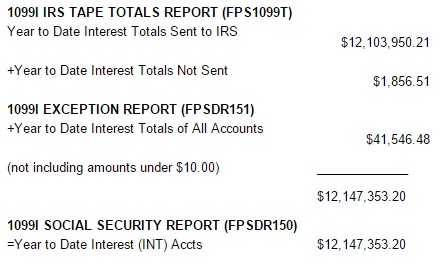

The combined year-to-date interest of the Totals Sent to IRS, and the Totals Not Sent fields on the 1099I IRS Tape Totals report plus the institution totals in the Total of All Accounts field on the 1099I Exception Report should match theYear to Date Interest (INT) Accts field on whichever report you choose from number one above (Customer Information, Numeric Listing, Alpha Listing, or Social Security).

|

Note: You should also be able to balance these totals with the year-to-date total interest posted from the Deposit System. To do this, run Report Writer or GOLDWriter to pull in the total year-to-date interest using the Interest Earned Last Year field (DMYITL) on the Deposit Interest Fields screen (function 9/10). Run this on the live (online) set, not the monthend set. |

|---|

For further information on year-end balancing, please refer to the Deposit Year-End Manual in DocsOnWeb.