Navigation: Teller System > Transactions > Deposit Transactions >

Tran Code 1009-83, Inquiry/Close Transaction

The Inquiry/Close transaction (tran code 1009-83) allows you to first view a deposit account's balance before closing the account. This is a versatile transaction that can be varied according to how your institution wants to use this transaction.

Some accounts require a fee when the loan is closed. For example, if the owner of the account wants the account closed and a cashier's check made out for the amount, your institution may want to charge a fee for the cost of the cashier's check.

Other accounts, such as certificates, may require a penalty if the account closed earlier than term ending date. For example, if the product code includes a penalty for early withdrawal, you would need to make sure to include that penalty if the account closed prior to term.

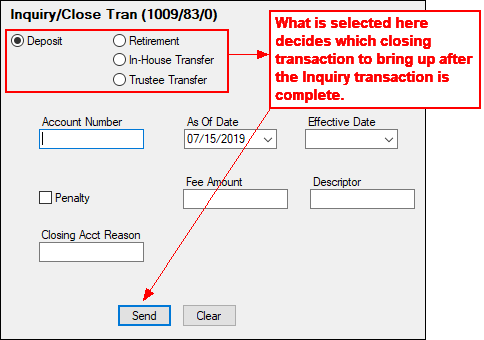

When you bring up tran code 1009-83 in CIM GOLDTeller, it first displays the inquiry transaction, as shown below:

|

Tip: If you do not see transaction code 1009-83 in your list of transaction codes on the Menu Design screen, complete the following steps to refresh the list and load any new transactions from Core Services (the Host):

1.While in CIM GOLDTeller, go to the Functions > Administrator Options > PC Institution Settings screen.

2.At the bottom of that screen is the <Date/Time Transactions Last Updated from Host> button. Click that and change the date to two years ago (e.g. "06/01/2017").

3.Click <OK> and log out of CIM GOLDTeller, then log back in.

4.Re-open CIM GOLD and access CIM GOLDTeller. A message will appear such as, "Updating transactions. This may take a while. Please be patient. 18 Host Transactions Downloaded."

5.Now go to the Functions > Administrator Options > Menu Design and you should be able to see that transaction and add it to the Transaction Menu in CIM GOLDTeller. |

|---|

After you enter information in those fields and click <Send> a second close transaction will appear. The close transaction that appears is dependent on which radio button you selected on tran code 1009-83 (Deposit, Retirement, In-house Transfer, or Trustee Transfer).

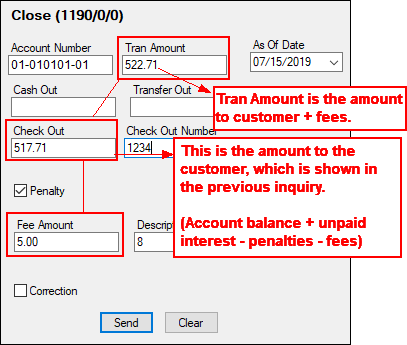

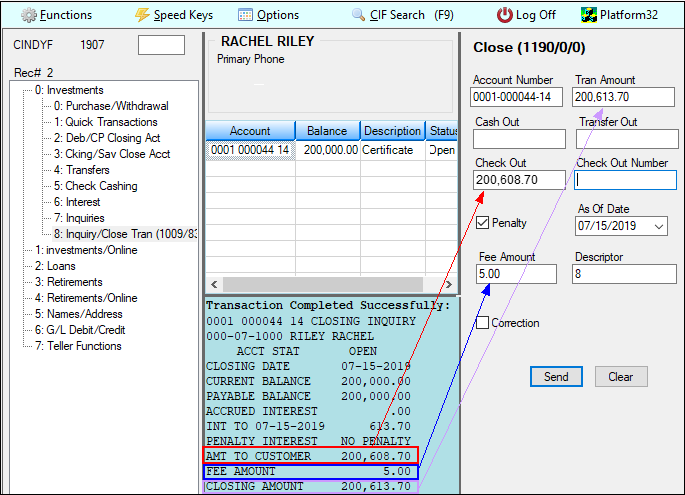

If you selected the Deposit radio button on tran code 1009-83, the Close transaction (tran code 1190-00) will be displayed, as shown below. For more information about this transaction, see the Close transaction (tran code 1190-00) topic.

|

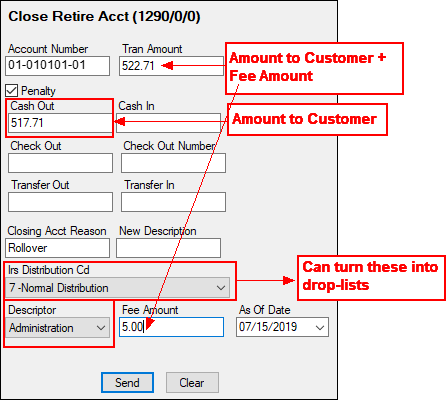

If you selected the Retirement radio button on tran code 1009-83, the Close Retirement transaction (tran code 1290-00) will be displayed, as shown below. For more information about this transaction, see the Close Retirement Account transaction (tran code 1290-00) topic.

|

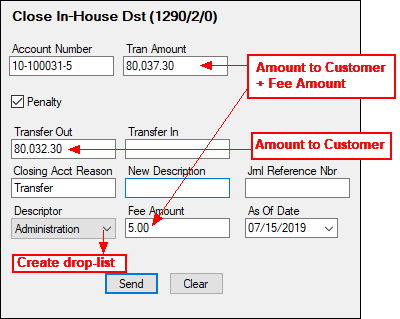

If you selected the In-House Transfer radio button on tran code 1009-83, the Close In-House Distribution transaction (tran code 1290-02) will be displayed, as shown below. This transaction is only for retirement accounts. For more information about this transaction, see the Close In-House Distribution transaction (tran code 1290-02) topic.

|

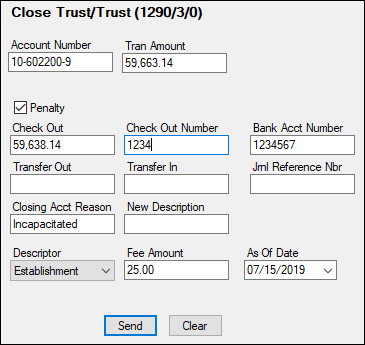

If you selected the Trustee Transfer radio button on tran code 1009-83, the Close Trust/Trust transaction (tran code 1290-03) will be displayed, as shown below. For more information about this transaction, see the Close Trust/Trust transaction (tran code 1290-03) topic.

|

You will need to enter the Amount to Customer in the Cash Out, Check Out, or Journal Out field. The Amount to Customer is shown in the fourth quadrant after the first transaction is run, as shown below:

Finish entering any information in the provided fields, then click <Send>. The account is then closed.

IMPORTANT: You will not be able to reverse this transaction. Once completed, the account is closed. If this was done in error, you will need to open a new account with the totals from the account you just closed. This may require assistance from GOLDPoint Systems. |

|---|

You can assess a fee when running this transaction. Fees are different from penalties (see below). Fees are what your institution charges for running the transaction. You may decide to only charge a fee if certain circumstances exist when closing the account. For example, if the customer is closing an account and wants a cashier's check made out to them for the amount, you could charge a fee for the convenience of printing a cashier's check.

Each fee must include a descriptor. Descriptors flag the fee amount with a description of what the fee was for. They are also used in the Autopost to post the fee amount to a specific General Ledger account. For more information on descriptors, see the Descriptor Code Setup topic.

We suggest that if you are going to assess a fee, use a drop-list for the Descriptor field. See the View/Modify Droplists topic on how to create drop-list fields.

Also, you must make sure that the closing transactions (see above) have the Fee Amount and Descriptor fields are displayed on those transactions. See the Field Properties topic for information on how to hide and unhide fields on the transaction.

Fees are subtracted from the final closing balance on the account. |

Check the Penalty box on the initial tran code 1009-83 screen and the system will check if any penalties exist for this account. Penalties are calculated when a deposit account closes earlier than the term (e.g., closing a CD account before the end of the term). Penalties are determined by the product code. See the Penalty Code field description on the Interest tab of the Product Codes screen in the Deposits in CIM GOLD help.

The system will automatically calculate the penalty amount, if one exists. If a penalty does not exist on the account for closing early, the message "No Penalty" will display in the output of the inquiry. Penalties usually only exist on certificate accounts. The Penalty Code field is pulled from Deposits > Account Information > Account Information > Features/Options tab.

You can also run tran code 1008, Penalty Inquiry, before this transaction to view if any penalties exist on this account. See Tran Code 1008, Penalty Inquiry, for more information.

We strongly suggest you always check the Penalty box on the transaction. If that box is not checked, penalties will not be part of the final closing account amount.

Penalties are subtracted from the final closing balance on the account. |

The results of the inquiry and close transaction, when all runs smoothly, is for the account to close. If you are rolling over the close amount, you will want to run this transaction as a Journal Out, then roll that amount into another account owned by the customer, or open a new account with the closing account's balance.

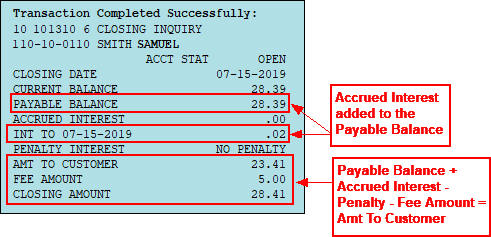

If the account is due any accrued interest, that interest will be added to the current balance to arrive at the Amount to Customer in the Inquiry. Fees and penalties are subtracted from the final closing balance to arrive at the Amount to Customer, as shown below:

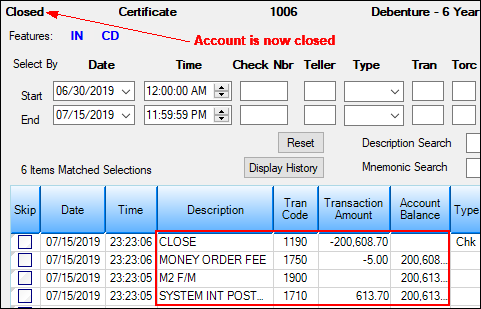

See the following Deposit History showing the results of the close transaction:

|